For general contractors, keeping accurate financial records is key to success. An important but often overlooked part is tracking refunds and credits from material suppliers. Proper recording of these transactions is crucial because mistakes can lead to overspending or misunderstandings about a project’s financial health. Good tracking helps avoid lost income and keeps financial records clear.

Why Track Refunds?

In construction, buying materials in bulk and in advance is common. This ensures contractors are ready for different project needs. But sometimes, not all materials are used, and returning them is typical. Managing these refunds well is crucial for several reasons:

Understanding Refund Options

Contractors can get refunds as cash, store credit, or back on a payment card. Each affects cash flows differently.

Importance of Tracking Refunds

Accurate Financial Reporting: Detailed tracking of refunds helps maintain correct financial records, crucial for the business’s financial health.

Effective Budget Management: By monitoring refunds accurately, contractors can adjust their budgets properly and avoid financial mistakes.

Using Resources Wisely: Keeping track of store credits or cash refunds allows contractors to reallocate these resources efficiently, potentially reducing future out-of-pocket expenses.

Common Refund Challenges

Dealing with Many Suppliers: Projects often have many suppliers, making it hard to keep track of where refunds are due.

Handling Different Payment Methods: Refunds might be processed differently based on the original payment method, so they need careful attention to ensure they’re recorded correctly.

Failure to track refunds can lead to

Lost Income: If GCs don’t keep track of store credits, they might forget to use them before they expire, leading to lost money.

Inaccurate Job Costing: Missing refund records can throw off a project’s budget and job costing, making financial planning less accurate.

Overpaying Vendors: If GCs don’t remember that they have credits with suppliers, they might end up paying more than they need to on future orders.

Wasted Time: A lot of extra time can be spent sorting out what went wrong with untracked refunds.

Missed Refunds: Without precise tracking, some credits or refunds might not be claimed at all, slipping through the cracks.

To overcome these challenges, contractors should use robust systems or software designed to log and monitor all transactions related to material purchases and returns. This simplifies financial management and helps maintain a clear view of a project’s financial status and overall profitability.

How APARBooks Helps

APARBooks offers a simple approach for tracking refunds, ensuring that general contractors can easily manage their financial transactions with clarity.

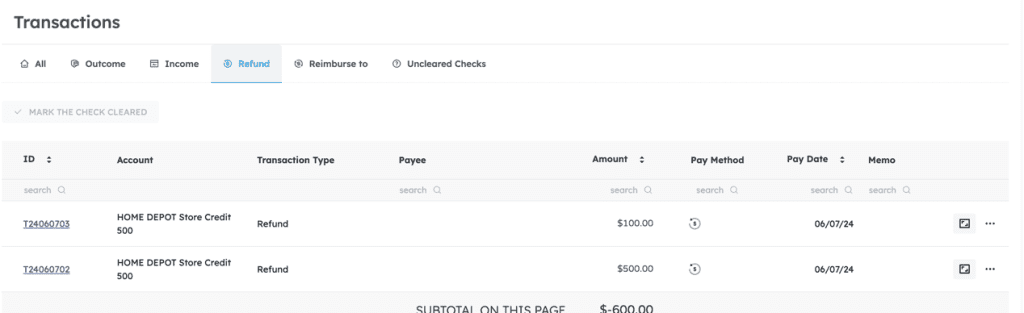

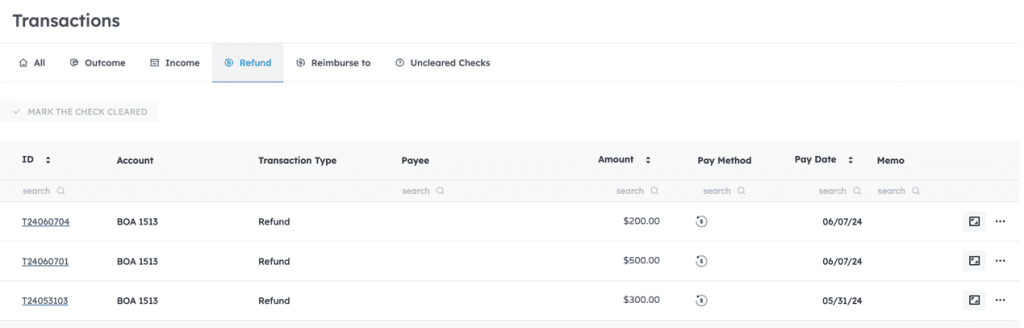

APARBooks enables users to direct refunds to specific accounts such as cash, checking, or store credit and offers a comprehensive view of all transactions with easy search and filter options, ensuring precise and up-to-date financial records for enhanced management and reporting.

Benefits of Using APARBooks for Tracking Refund

Improved Accuracy

APARBooks makes it easy to record refunds accurately, ensuring all financial records are up-to-date and correct. This helps with better financial reporting and simpler audits.

Better Cash Flow Management

With clear information on where refunds are going, whether it’s cash, checking accounts, or store credits, APARBooks helps you manage your cash flow effectively. This means you can plan spending and savings more efficiently.

Simplified Financial Processes

Tracking refunds is straightforward with APARBooks. You can quickly find transactions, reducing the time you spend on bookkeeping and making it easier to keep your finances organized.

Prevents Financial Mistakes

By keeping detailed records of all refunds, APARBooks helps avoid the common errors that occur from untracked or wrongly allocated refunds, safeguarding your budget.

Supports Better Decision-Making

Clear and concise financial information allows for smarter business decisions. APARBooks provides the data you need to forecast future needs and plan strategically.

Using APARBooks to handle refunds simplifies your financial management tasks, enhances accuracy, and supports more informed business decisions in the construction industry.

Take control of your refunds with APARBooks. Simplify your financial management today and make smarter decisions for your projects. Discover how APARBooks can boost your construction business’s profitability. Don’t delay—regain financial clarity and control now. Contact us for a personalized demo today!