As a business owner, have you ever received an unexpected increase in your workers’ compensation premiums? Have you realized that you might be losing money due to inaccuracies in your payroll management—something that could be easily fixed? You won’t believe how much an audit letter can amount to—sometimes far larger than you think—and the worst part is, it will be sent to you every year!

You might find yourself stressed, trying to understand the intricate relationship between payroll management and workers’ compensation costs.

Here are some questions you might be asking yourself after receiving a premium hike:

How did my workers’ comp premiums increase by so much in a term?

What factors contribute to the sudden rise in my workers’ compensation premiums?

How do I identify and correct issues in my payroll records that affect my premiums?

What steps can I take to ensure accurate payroll reporting and avoid future premium hikes?

In the realm of construction and other labor-intensive industries, managing workers’ compensation premiums and audits is crucial for maintaining financial stability and legal compliance. Workers’ compensation insurance provides essential protection for both employees and employers by covering medical expenses and lost wages for employees who are injured on the job.

However, the cost of this insurance is directly influenced by the accuracy of payroll records and classifications, making meticulous record-keeping a non-negotiable task for businesses such as yours.

To answer your questions one by one and better spot the issue, you must first understand the basic logic of Workers’ Compensation Premiums and Audit.

What Are Workers’ Compensation Premiums?

Workers’ compensation premiums are the payments made by employers to insurance companies in exchange for coverage that protects employees in case of work-related injuries or illnesses.

The premium amount is calculated based on factors such as the total payroll, the classification of employees, and the company’s claims history. Higher-risk jobs, such as construction works, typically attract higher premiums. Accurate reporting and classification of payroll are essential to ensure that premiums are fair and reflective of the actual risk.

The Role of Accurate Payroll Information

Accurate payroll information is foundational to calculating workers’ compensation premiums. These premiums are determined based on the total payroll and the classification of employees, reflecting the risk associated with different job functions.

For instance, an office clerk has a lower risk (and thus a lower premium) compared to a construction worker. Ensuring that each employee is correctly classified and that payroll records are precise helps in determining the correct premium amounts.

Incorrect payroll records can lead to significant issues during a workers’ compensation audit, which is conducted to verify that the premium paid accurately reflects the company’s risk exposure. If payroll data is inaccurate or misclassified, it can result in substantial financial repercussions and administrative headaches for your business.

What Is a Workers’ Compensation Premiums Audit?

A workers’ compensation premiums audit is an examination of an employer’s payroll records and classifications by the insurance company to ensure that the premiums paid are accurate. This audit can be conducted annually or at the end of the policy period.

During the audit, the insurer reviews the company’s payroll data, employee classifications, and other relevant information to confirm that the premiums charged align with the actual risk. Discrepancies found during the audit can result in adjustments to the premium, either increasing or decreasing the amount owed, as well as fines and legal issues.

Consequences of Inaccurate Payroll Records

- Increased Premium Costs: One of the most common issues arises when employee reimbursements are incorrectly recorded as salaries. This misclassification inflates the payroll amount, leading to higher workers’ compensation premiums. Overpaying for insurance can strain a company’s finances, diverting resources from other critical areas of the business.

- Audit Complications: During an audit, discrepancies between reported payroll and actual payroll can trigger further scrutiny. If auditors find inconsistencies or evidence of misclassification, it can result in fines, penalties, and a reassessment of premiums. This process can be time-consuming and costly, creating additional stress for business owners.

The penalties for non-compliance or inaccuracies can vary, but they may include surcharges of 25% to 50% of the original estimate, policy cancellation, or legal consequences (Hourly Pay & Workers’ Comp) (MyNewMarkets) (Farmer Brown Insurance).

- Legal and Compliance Issues: Inaccurate payroll records can also lead to legal challenges. Misclassifying employees or incorrectly reporting payroll can be seen as an attempt to defraud the insurance provider, leading to potential legal action and damage to the company’s reputation.

- Employee Relations: Errors in payroll can also affect employee trust and satisfaction. If reimbursements are incorrectly recorded and employees find discrepancies in their pay, it can lead to dissatisfaction and distrust, affecting morale and productivity.

Now that you have a clearer idea of how to spot and fix mistakes in your business, we can review these questions with the knowledge you have learned in the blog.

- How did my workers’ comp premiums increase by so much in a term?

Workers’ compensation premiums can rise significantly if there are discrepancies in payroll records or if employees are misclassified. Inaccurately accounting for salaries or mistakenly adding other expenses to worker salaries can result in a significant increase in premiums. This misreporting inflates the payroll amount, leading to higher workers’ compensation premiums when audited.

- What factors contribute to the sudden rise in my workers’ compensation premiums?

Several factors can contribute to an unexpected hike in premiums, including misclassified employee roles, inaccurate payroll data, and an increase in claims history. Additionally, incorrectly recording employee reimbursements as salaries can inflate your payroll, leading to higher premiums.

- How do I identify and correct issues in my payroll records that affect my premiums?

To spot and correct payroll issues, you should conduct regular internal audits and ensure accurate classification of employees. APARBooks offers tools to categorize reimbursements correctly, ensuring they are not mistakenly recorded as salaries. This accuracy helps prevent inflated payrolls and incorrect premium calculations.

- What steps can I take to ensure accurate payroll reporting and avoid future premium hikes?

Implementing best practices for payroll management is essential. Regularly review and update payroll records, ensure precise employee classification, and use reliable payroll software like APARBooks. The system can automate the categorization of expenses and ensure accurate payroll reporting, reducing the risk of premium increases due to errors.

Best Practices for Accurate Payroll Management

Since one of the most common mistakes in payroll management is when employee reimbursements are incorrectly recorded as salaries, APARBooks has developed a process with simple steps to ensure accurate categorization of reimbursements, reducing errors and potential financial and legal complications.

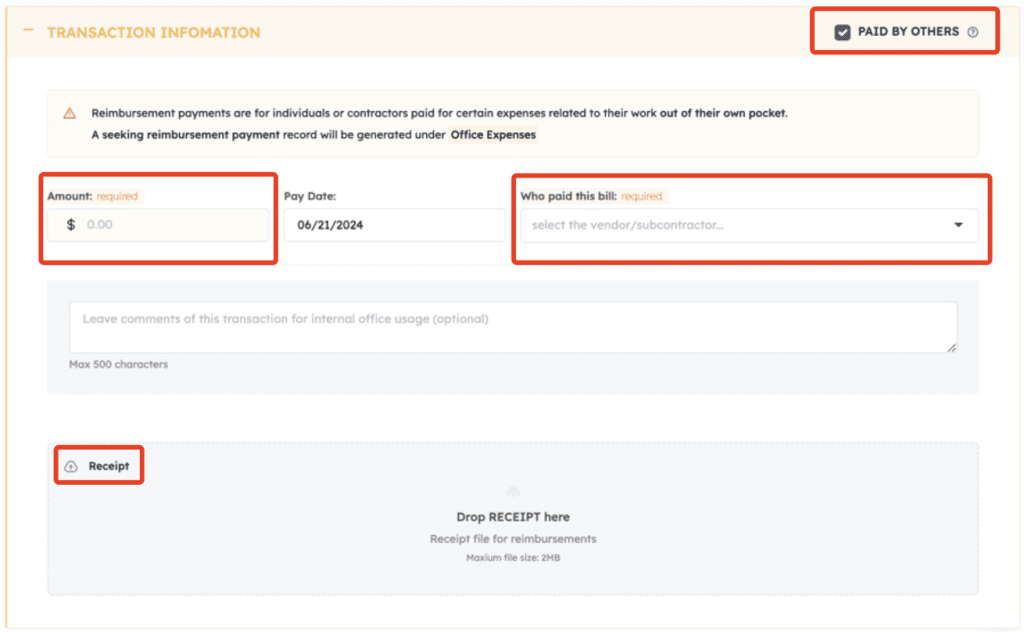

When recording an employee-paid transaction, simply confirm it is “paid by others”, input the amount and the employee who made the payment, and provide the receipt, this transaction will then automatically be categorized as a bill awaiting for reimbursement to the employee.

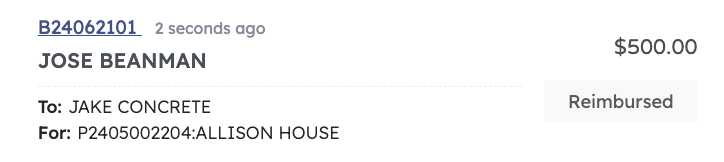

After you made the reimbursement payment, the system will automatically mark this payment “reimbursed”. This way, you will never have the hardship of categorizing employee reimbursements separately from other expenses, such as salaries.

For construction companies and other businesses relying on labor-intensive operations, managing workers’ compensation premiums and audits effectively is crucial. Accurate payroll information is at the heart of this process, helping to ensure fair premium costs, smooth audits, and compliance with legal standards.

By prioritizing the payroll management, you can avoid the costly pitfalls of misclassification and overpayment, safeguarding your business’s financial health and maintaining good standing with both employees and insurers.

Don’t let payroll management challenges compromise your business. Experience the ease and accuracy that APARBooks brings to your payroll processes.

Contact us today to learn more about how our innovative solutions can transform your payroll management and protect your bottom line.