In construction projects, the financial transactions are diverse and multifaceted. It’s common for general contractors to incur expenses that are not covered by the project contract. These expenses may include purchases from suppliers or subcontractors that fall outside the scope of the contract. When this happens, the general contractor typically pays for these expenses out of their own pocket and then seeks reimbursement from the project owner.

However, this process can lead to misunderstandings and disputes if there’s a lack of clarity around whether an expense is part of the contracted work or a separate reimbursable cost. Project owners may assume that all invoices from the general contractor are covered by the contract, leading to disagreements over payment responsibilities.

At APARBooks, we provide a robust solution to streamline this process and minimize conflicts.

The Importance of Proper Classification

Proper classification of invoices is crucial in construction accounting for several reasons:

Financial Transparency

Clear classification helps both general contractors and project owners track expenses accurately, avoiding hidden costs or unexpected charges.

Accurate Budgeting

Distinguishing between contract and reimbursement invoices allows for more precise budgeting and cash flow management.

Reduced Disputes

Proper classification prevents misunderstandings and conflicts by clearly defining each expense.

Efficient Reimbursements

Correctly categorized invoices ensure a smoother and faster reimbursement process, helping contractors maintain healthy cash flow.

Compliance and Auditing

Accurate classification simplifies compliance with accounting standards and regulations, making audits straightforward and ensuring all records are correct.

The APARBooks Solution

APARBooks offers a comprehensive accounting software tailored specifically for the construction industry. One of the standout features of our software is the ability to clearly differentiate between contract invoices and reimbursement invoices. This distinction is crucial for maintaining financial transparency and avoiding conflicts.

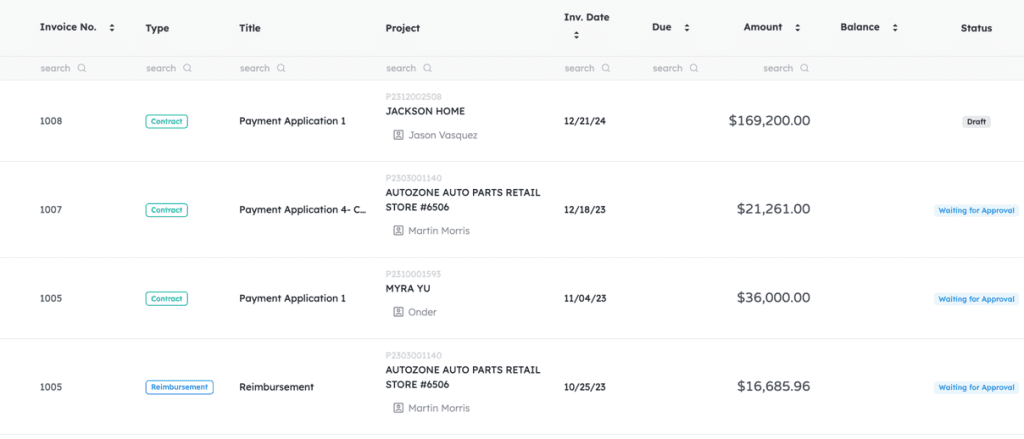

APARBooks classifies invoices as “Contract” or “Reimbursement” to ensure financial transparency and reduce disputes.

Benefits of Using APARBooks

Enhanced Transparency

Clear categorization of invoices reduces misunderstandings and promotes transparency between general contractors and project owners.

Streamlined Reimbursements

By clearly tagging reimbursement invoices, contractors can ensure timely and accurate reimbursement from project owners.

Reduced Disputes

Detailed documentation and automated notifications help minimize disputes and foster better relationships between stakeholders.

Improved Financial Management

APARBooks’ comprehensive tracking and reporting features aid in better financial management and planning for future projects.

Ensure financial transparency and streamline your construction project accounting with APARBooks. Our software’s ability to classify invoices as “Contract” or “Reimbursement” helps prevent disputes and enhances your financial management. Contact us today for a demo and see how APARBooks can simplify your accounting needs!