In the construction industry, managing finances and ensuring project completion can be a delicate balance. Understanding the intricacies of retainage is essential for both contractors and project owners. It influences cash flow, project timelines, and overall project management.

In this blog, we will explore what retainage is, why it is important, and how it impacts various stakeholders in the construction process. As a general contractor, gaining insight into retainage and especially how it can become an automated process that helps you to navigate the financial aspects of your construction projects more effectively.

First of all… What is Retainage?

Retainage, also known as retention or holdback, is a common practice in the construction industry where a portion of payment, typically 5-10%, is withheld until a specific milestone or the completion of the entire project.

This practice applies to both general contractors and subcontractors and serves as a form of security for the client (usually the project owner), ensuring that the work meets the agreed-upon standards. Retainage provides the client with recourse if they are not satisfied with the work, holding back payment until the project is approved.

Purpose & Importance of Retainage

Retainage, or retention, plays a crucial role in construction projects by providing financial incentives for contractors to complete their work efficiently and to the owner’s satisfaction. Typically withholding 5-10% of payment until the project reaches a specific milestone or is fully completed, retainage serves as a form of security for both the project owner and the contractor. It ensures quality assurance and encourages contractors to meet or exceed performance standards, addressing any defects or incomplete work.

Retainage is particularly important in the final stages of a project. Without it, a contractor who has received full progress payments might choose to abandon the project if disputes or issues arise. For owners, retainage provides a financial cushion to cover costs if a contractor or subcontractor defaults. It ensures funds are available to pay subcontractors or hire another contractor to complete the job if necessary.

However, retainage can also create cash flow challenges for contractors. They must manage ongoing expenses, such as employee wages, insurance, supplies, and financing new projects, while waiting for the final payment. This can strain small businesses, leading to potential tensions in business relationships. Despite these challenges, retainage remains a vital tool for ensuring project completion and maintaining high standards in construction work.

How Does Retainage Work?

Retainage is more complex than regular billing. Even though you don’t bill for retainage until the project’s end, it should be recognized as a separate receivable amount throughout the project’s duration.

For example, consider a $10,000 line item with a 10% retainage. If you’re 10% complete with that item, you would bill $900 and hold $100 in retainage.

As you progress and bill another 10% of that line item on each application, an additional $100 would be held in retainage each time. By the end of the project, when you’re 100% complete, you would have billed $9,000 and held $1,000 in retainage.

Retainage becomes a true receivable amount as the project nears completion. Typically, retainage is released upon completion of the project or after a specified period, depending on the contract terms. For instance, if a project involves 10 payments of $10,000 each with a 10% retainage, the project owner would pay $9,000 each time. The remaining $10,000 in retainage would be released upon project completion or a specified period afterward.

Retainage, while it may not seem significant in individual installments, adds up over the project’s duration, providing a strong incentive for contractors to finish the job. Upon meeting the retainage terms, the retained amount is paid to the contractor, who must then pay the withheld money to subcontractors. The percentage and terms of retainage can vary depending on the project’s stage and specific contract details, reflecting the diverse practices across different jobs and states.

Challenges When Handling Retainage

Financial Hardships

Retainage can cause significant financial strain, especially for subcontractors whose work is completed early in the project. The construction industry involves multiple stakeholders, including owners, contractors, subcontractors, sub-subcontractors, suppliers, and labor workers. Subcontractors may consider their projects complete, but contractors might see them as part of the larger project. Retainage is withheld until the entire project is finished, delaying payment to subcontractors. When paid, retainage goes to the contractor first, who then distributes it to subcontractors and suppliers.

Delayed Payment and Abuse

Retainage can result in delayed payments and potential abuse. Some contracts and state regulations specify how long retainage funds can be held, but some parties hold onto it until the last possible day. Disagreements over job completion standards can lead to further delays. Contractors sometimes withhold a greater percentage from subcontractors than what the owner withholds from them, increasing financial risk for subcontractors.

Administrative Burden

Managing retainage involves significant bookkeeping and administrative tasks, adding to the complexity of accounting and escrow management for all parties involved.

How Can APARBooks Help?

While other aspects of the challenges may be difficult to resolve, APARBooks can take away one of the most headache-inducing problems: the bookkeeping challenge. Tailored for the unique needs of contractors and subcontractors, APARBooks offers data storage, a clear user interface for easy tracking across different projects, and automated calculations so you never get the numbers wrong.

With APARBooks, setting a preset retainage rate is effortless. By simply adding the retainage rate when creating an invoice for a project, the system will automatically display and include this rate in all subsequent calculations.

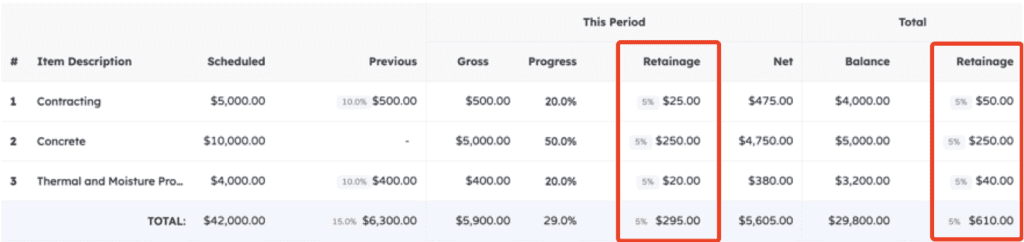

Every time you generate an invoice, APARBooks will provide precise calculations for each cost item, clearly showing the retainage amounts for individual line items of the current period, as well as the overall totals.

This comprehensive approach ensures that you never miss a detail, maintaining accuracy across the board. The software also highlights key figures like gross, net, progress, and balance amounts, making it easy to track financial performance and retainage at a glance.

With automated calculations and a user-friendly interface, APARBooks takes the complexity out of managing retainage, giving you more time to focus on what truly matters.

Interested in learning more about your key to succeed in retainage bookkeeping?

Schedule a demo today to eliminate the accounting headaches and streamline your financial management.