You’ve been dreaming about this residential construction project for years. You meticulously planned every detail, hired a reputable general contractor, and can’t wait to enjoy your new home. But there’s one often overlooked aspect of construction projects that could derail your dream home build if not handled properly – preliminary notices and lien releases.

Each year, thousands of homeowners face surprise liens and legal battles after construction wraps up. The root cause? Failing to proactively manage preliminary notices from contractors and suppliers from the very start. A preliminary notice is a document stating that a contractor or supplier has furnished labor or materials to your property and retains lien rights until they’ve been paid in full.

If your general contractor doesn’t pay their subcontractors and suppliers as required, those companies can file a lien on your home to recoup what they’re owed – even if you already paid your general contractor. It’s a messy situation that can stall your ability to refinance, sell, or simply enjoy your newly renovated home until the liens are resolved.

The best way to prevent these problems? Ensuring your contractor provides proper lien releases as work progresses and payments are made.

What are Lien Waiver and Release?

There are four main types of lien releases:

- Conditional lien waiver on progress payment

- Issued when contractor receives partial payment for completed work.

- Lien rights are waived only after payment is received.

- Common for hitting major project milestones (foundation, framing, etc.)

- Unconditional lien waiver on progress payment

- Also issued when contractor receives partial payment.

- Lien rights were waived immediately upon signing.

- Used when high trust between parties and the payment does not require any further confirmation.

- Conditional lien waiver on final payment

- Issued when contractor receives final payment for completed project.

- Waiver only valid once payment successfully clears bank.

- Unconditional lien waiver on final payment

- Issued when final payment received.

- Contractor waives all lien rights immediately, no conditions.

The Importance of Lien Release

For homeowners, having full visibility into the lien release process is critical for protecting your investment. Lien releases provide proof that contractors have been paid for their work, preventing them from filing unexpected liens on your property down the road.

If your general contractor tries to skip providing lien releases during a project, it raises a major red flag. It likely signals issues with their payment processes that could allow subcontractor and supplier liens to materialize later, even if you’ve already paid the general contractor in full.

The risks of not managing preliminary notices and lien releases properly are severe:

Subcontractors and suppliers can place liens on your home if they go unpaid by the general contractor, even after you’ve paid the GC.

Unresolved liens can stall your ability to refinance, sell, or even enjoy your newly renovated home until resolved.

You may face costly legal battles to remove invalid liens that should have been cleared with a proper lien release.

Ensuring your contractor provides lien releases as payments are made provides vital protection by:

Documenting a clear trail that each party has been compensated for their portion of the work.

Eliminating any lien rights they could attempt to claim on your property in the future.

Preventing surprise liens from derailing your renovation or construction project long after it is “completed.”

Properly managing lien releases may seem like an administrative hassle, but it is well worth the effort to safeguard your major investment in your home from potentially disastrous legal disputes over payments.

How APARBooks Help

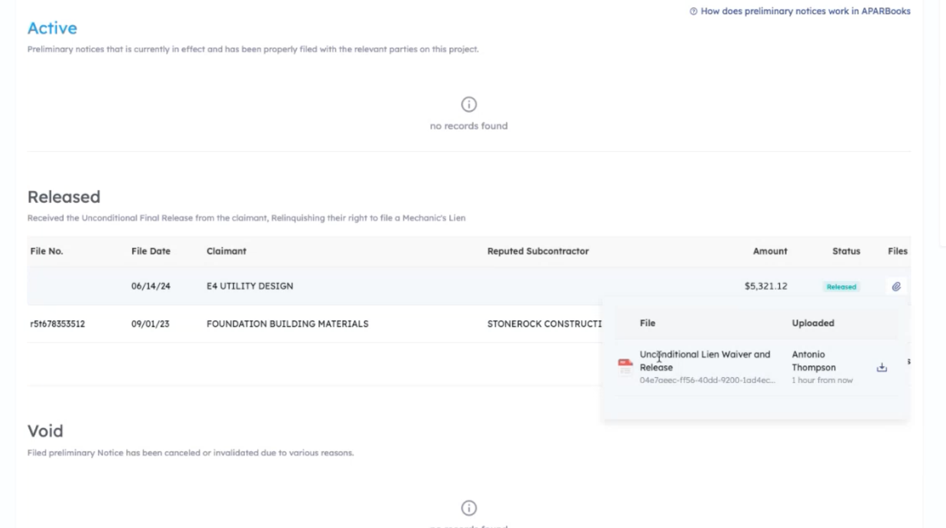

This is where construction accounting software like APARBooks can be a game-changer. APARBooks provides an integrated platform where your contractors and suppliers submit preliminary notices electronically. As the homeowner, you get a clear view into these notices and can monitor when lien releases and payments are being exchanged. When your general contractor marks a preliminary notice as paid within APARBooks, you immediately see the corresponding lien release they’ve provided.

General Contractor’s view

Project Owner’s view

This transparency allows you to verify proper lien management is happening in real-time as work progresses on your project. You don’t have to wait until the end to find out your contractor dropped the ball on payments.

Why choose APARBooks?

Full Transparency

Get real-time visibility into preliminary notices, lien releases, and payment exchanges between contractors and suppliers.

Effective Coordination

Facilitate clear communication and document sharing among all parties involved in your project. This helps build positive working relationships and keeps everyone aligned on what work has been completed, what payments are owed, and that lien releases are being executed consistently.

Lien Protection

Verify proper lien management as work progresses, preventing surprise liens from derailing your project.

Proactive Approach

Leverage APARBooks’ integrated platform to stay ahead of potential payment issues and legal disputes.

Real-Time Monitoring

Track lien releases and payments in real-time, instead of waiting until project completion.

With APARBooks, homeowners can safeguard their investment, ensure accountability, and keep construction projects running smoothly from start to finish.

While no one goes into a construction project expecting to deal with liens and legal disputes, they are an unfortunate reality when preliminary notices aren’t handled correctly. Do not let an admin oversight turn your dream renovation into a nightmare of liens, court battles, and unfinished work.

FAQs About Lien Releases, Preliminary Notices, and How APARBooks Helps

1. What is a preliminary notice in construction, and why is it important for homeowners?

A preliminary notice is a document sent by contractors or suppliers to inform property owners of their lien rights. Even if a homeowner pays the general contractor, unpaid subcontractors can still file a lien without this notice being properly managed. APARBooks allows you to track preliminary notices in real-time, preventing such legal surprises.

2. How does a lien release protect homeowners during a construction project?

A lien release confirms that a contractor or supplier has been paid and waives their right to place a lien on the property. APARBooks ensures lien releases are exchanged as payments are made, creating a secure and transparent workflow for all parties involved.

3. Can APARBooks help homeowners avoid legal issues related to construction liens?

Yes. APARBooks provides real-time monitoring of lien releases and preliminary notices, helping homeowners proactively confirm that subcontractors and suppliers have been paid, avoiding disputes and potential legal issues post-construction.

4. What types of lien waivers does APARBooks support?

APARBooks supports all major lien waiver types, including:

-

Conditional and unconditional lien waivers on progress payments

-

Conditional and unconditional lien waivers on final payments This helps ensure you receive the correct documentation based on project milestones and payment stages.

5. Why should homeowners require their contractor to use APARBooks?

When contractors use APARBooks, homeowners gain complete visibility into the financial side of their project—tracking payments, monitoring lien releases, and ensuring all suppliers and subcontractors are paid. This protects homeowners from surprise liens and unresolved financial disputes.

6. What makes APARBooks different from traditional construction management tools?

Unlike traditional systems, APARBooks focuses specifically on payment transparency and lien release automation. Its intuitive platform ensures all lien documentation is tied directly to payments, giving homeowners and project owners peace of mind throughout the construction process.

Leverage tools like APARBooks to get full visibility into lien management from day one. A little proactive effort goes a long way in protecting your investment and keeping your project running smoothly from start to finish. Take control with APARBooks today!