As a general contractor managing multiple projects simultaneously, keeping track of invoices and payments is a constant challenge.

Last year, we were handling a $4.2 million commercial building project with over 25 subcontractors. Our accounting team received an invoice from our drywall subcontractor for $78,500. During our busy period, the invoice was paid but not properly recorded in our system. Three weeks later, the subcontractor followed up about the ‘unpaid’ invoice. Without a clear record of the previous payment, and under pressure to maintain good relationships with our trades, we processed what we thought was the original payment – not realizing it was actually a duplicate.

This oversight snowballed throughout the project. By the time we completed the building, our books showed a significant discrepancy. We discovered we had made multiple duplicate payments to various subcontractors, but tracking down exactly where and when these duplications occurred was nearly impossible due to our manual record-keeping system.

The project, which should have generated a 12% profit margin, only yielded 8% – representing a $168,000 loss in potential profit. Beyond the financial impact, our team spent countless hours trying to reconcile the books, creating additional overhead costs and taking time away from other critical projects. This experience made us realize we needed a more robust system to prevent such costly mistakes.

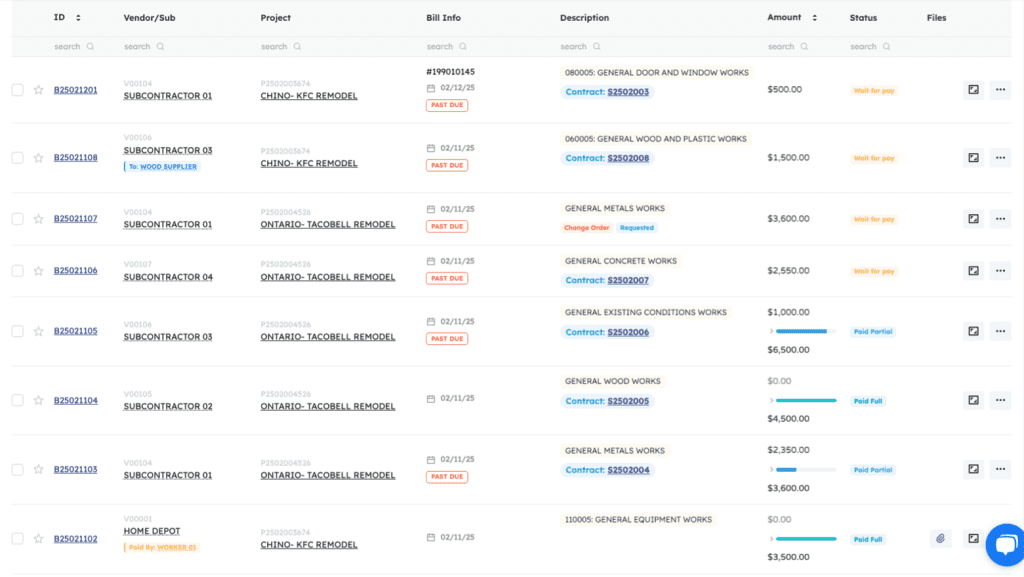

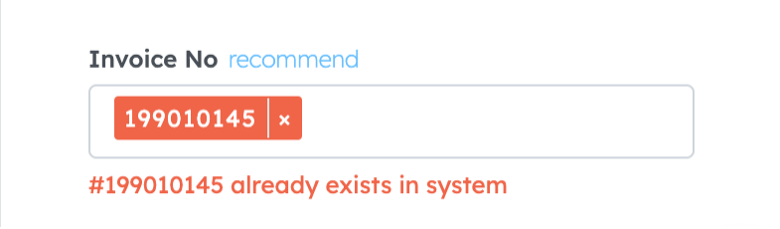

Implementing APARBooks transformed our invoice management process. The system automatically generates unique invoice numbers for every transaction and flags potential duplicates immediately. When we recently received the same invoice twice from a concrete supplier, the system instantly alerted us that the invoice number already existed in our database.

This simple but effective feature has completely eliminated our double-payment issues. Plus, with APARBooks’ detailed digital record-keeping, we can easily trace any payment back to its original invoice, giving us complete visibility into our financial transactions. Our project profitability has increased by 15% since implementing the system, and our accounting team saves approximately 10 hours per week on manual reconciliation tasks.