As a general contractor or project owner, staying on top of who you owe money to on a job is crucial. With so many subcontractors, suppliers, and moving payment pieces, it’s easy for bills to slip through the cracks.

That’s where preliminary notices come in. These legal documents require subs and suppliers to officially notify you upfront about their work on the project and how much you’ll owe them. Yeah, it’s one more thing to track – but ignoring preliminary notices can lead to costly lien headaches down the road.

Understanding Preliminary Notice

What is a Preliminary Notice?

It’s a document sent by contractors, suppliers, or equipment lessors to inform project owners about their work on a construction project.

Purpose of the Preliminary Notice

A proactive communication tool that keeps all project parties informed and helps prevent payment issues before they arise.

Who Receives It?

Besides the project owner, the notice often goes to the lender, general contractor, and other top-tier parties involved in the payment chain.

State Requirements

Many states mandate that subcontractors and suppliers send a preliminary notice to preserve their right to file a mechanics lien in case of non-payment.

Variations in Name

Depending on the project location, it might be called a Notice to Owner (NTO), Notice of Furnishing, pre-lien notice, or another similar term.

Timing of the Notice

Sent at the beginning of a project, typically before any payment disputes or due payments arise.

Why are Preliminary Notices Crucial?

For general contractors (GCs), managing multiple projects and numerous transactions can often lead to oversight. Large accounts can easily lose track of whom they owe and how much. Preliminary notices help by:

Ensure Timely Payments

Keeps cash flow steady by making sure everyone is paid on time.

Legal Protection

Helps avoid disputes and ensures adherence to payment laws.

Better Project Management

Keeps projects running smoothly by managing communications about payments.

Increase Transparency

Builds trust by maintaining clear records of financial transactions.

Risk Management

Detects potential problems early, allowing for quick solutions.

Risks of ignoring preliminary notices

Regularly checking the status of preliminary notices is essential in construction management. Here are some risks associated with not keeping track of these notices:

Mechanics Liens

Unpaid preliminary liens can lead to a mechanics lien on the property, complicating property sales or refinancing.

Legal and Financial Costs

Ignoring liens can result in costly legal battles, including lawyer fees and court expenses.

Project Delays

Disputes over liens can stop project work, leading to delays and increased costs.

Damaged Relationships

Not paying can hurt relationships with subcontractors and suppliers, potentially affecting future projects.

Higher Costs Later

Future subcontractors might ask for payments upfront, increasing project costs.

Reputation Damage

Public disputes and liens can harm the reputation, making it harder to find partners or investors later.

Paying liens on time helps avoid these issues, ensuring smoother project progress and maintaining good business relationships.

Getting Paid? Get That Lien Release

Construction is all about protecting your money. So once payments start flowing, you’ve got to lock in lien releases to make sure everyone’s settled properly. Here’s how that process usually goes:

Obtaining Conditional Releases

Secure a conditional lien release from each subcontractor or supplier, which states that lien rights are conditionally waived until payment is received.

Making the Payment

After obtaining the conditional release, proceed with making the payment as outlined in the contract.

Securing Unconditional Releases

Once payment is confirmed, request an unconditional release from each party, indicating full waiver of their lien rights for the paid amount.

Documentation and Record-Keeping

Keep detailed records of all payments and lien releases. This documentation is vital for resolving disputes and proving financial compliance.

Legal and Compliance

Follow local and state laws regarding lien processes, including the use of specific forms and meeting deadlines.

Final Inspection and Release

Before making final payments, conduct a final inspection or approval of the work. Then, obtain a final unconditional release covering all project work, ensuring no further claims.

These streamlined steps help general contractors and property owners effectively manage the lien release process, ensuring legal compliance and protecting the property from future lien-related issues.

How APARBooks Help?

At APARBooks, our accounting software helps GCs and project owners manage these notices and payment obligations from start to finish.

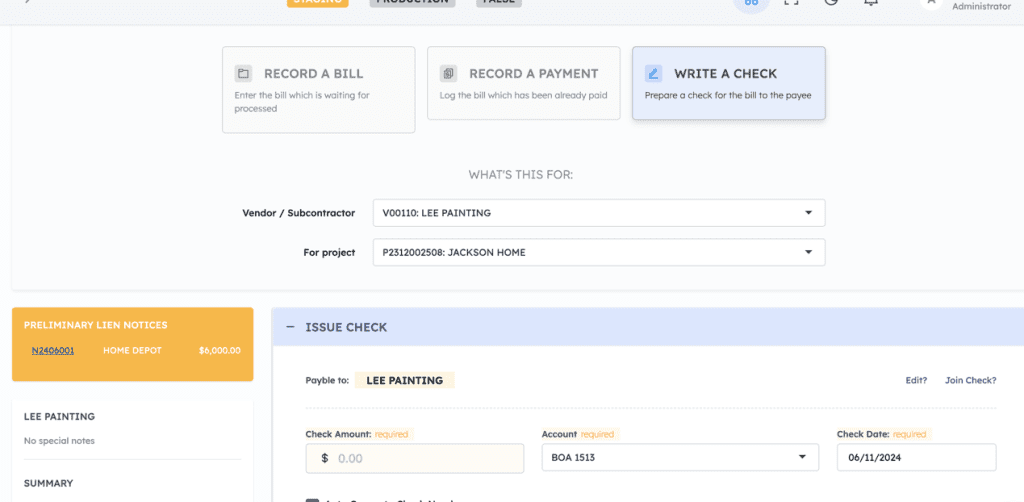

Before issuing any payments, APARBooks ensures that GC and project owners can view any relevant preliminary notices directly on the payment page. This feature allows contractors to confirm the status of all notices, ensuring that all financial obligations are met before proceeding.

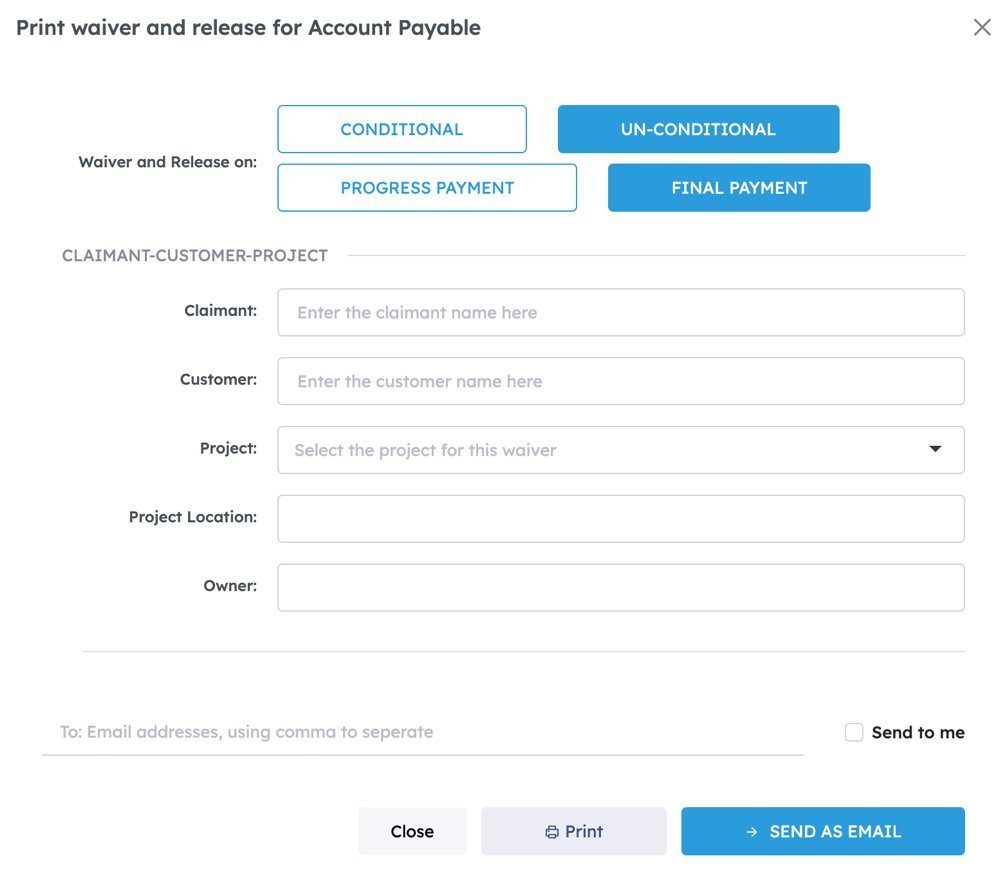

Our system can automatically generate four types of waiver and release forms—conditional and unconditional, for both progress and final payments. It includes 13 specific versions to ensure compliance with local lien laws. Easily create and send these forms via print or email directly from the interface, simplifying the management of legal documentation for construction payments.

Why Choose APARBooks?

Preliminary Notice Management

Clear Notice Visibility

Before releasing any payments, APARBooks displays all relevant preliminary notices right on the payment page. This allows you to easily verify notice compliance and prioritize who needs to be paid.

No Missing Paperwork

By surfacing notices during the payment process, you’ll never overlook or mishandle these legally required documents that can lead to costly lien claims down the road.

Automatic Lien Waiver Generation

One-Click Waiver Creation

After payments, automatically generate the necessary lien waivers—no manual input required.

State-Specific Compliance

Choose from 13 tailored waiver forms to meet specific state lien laws, ensuring full legal compliance.

Conditional and Unconditional Releases

Automatically select the right type of release for progress or final payments.

Flexible Delivery

Print or email waivers directly from the platform, simplifying communication with subcontractors and suppliers.

By integrating preliminary notices and automating lien waivers, APARBooks simplifies your workflows, ensuring you maintain lien rights and document all payment obligations efficiently, protecting your interests throughout the project.

Take Control of Your Construction Payments Today!

Discover how APARBooks can transform your project management by ensuring compliance, enhancing visibility, and simplifying paperwork. Schedule a demo and see first-hand how our solutions make managing preliminary notices and lien waivers effortless.

Join APARBooks now and take the first step towards seamless construction financial management!