In the construction industry, managing financial transactions and accounting relationships can be incredibly complex. One common scenario that illustrates this complexity involves receiving a bill from a material supplier or a third party who is not directly contracted with you, the general contractor.

This bill is for a transaction between the third party and one of your subcontractors. Handling this situation can be a significant challenge, particularly when it comes to recording and tracking the payment to the third party while making a deduction from the total subcontract amount with your subcontractor.

The Challenge

Imagine this: you, as a general contractor, receive an invoice from a material supplier or a third party for materials or services provided to one of your subcontractors. This supplier is not contracted with you, and the transaction is between them and your subcontractor.

You are now faced with the task of paying this third party directly and then adjusting your financial records to deduct this amount from the subcontractor’s total contract amount. This scenario raises several questions:

How do you accurately track and record the payment to the third party?

How do you ensure that the subcontractor’s contract amount reflects this deduction correctly?

How do you maintain clear and transparent financial records?

Consequences of Not Resolving This Challenge

Failing to address this challenge can lead to significant negative consequences:

Financial Discrepancies

Inaccurate recording of payments and deductions can lead to financial discrepancies, affecting project profitability.

Disputes and Legal Issues

Mismanagement of these transactions can result in disputes with subcontractors and suppliers, potentially leading to legal issues.

Cash Flow Problems

Poorly managed payments and deductions can create cash flow problems, impacting the overall project timeline and budget.

Damage to Reputation

Inconsistent and unclear financial practices can harm your reputation, making it difficult to maintain strong relationships with subcontractors and suppliers.

Shortcomings of Traditional Construction Accounting Systems

Traditional construction accounting systems often struggle to handle these complex scenarios effectively. Here are some common shortcomings:

Manual Processes

Traditional systems often rely on manual processes for recording and tracking payments and deductions, which are prone to errors and inefficiencies.

Lack of Integration

Many systems are not integrated with other project management tools, making it difficult to coordinate financial data across different platforms.

Limited Flexibility

Traditional systems may lack the flexibility needed to handle unique or complex accounting relationships, leading to cumbersome workarounds.

Poor Transparency

These systems can make it difficult to maintain clear and transparent financial records, as they may not provide adequate tools for tracking and reporting these transactions.

How Can APARBooks Help?

APARBooks, your modern construction accounting solution, is designed to tackle these challenges with simple steps, providing the tools and features necessary to simplify and streamline these complex accounting relationships.

Whenever you are recording a bill, a payment, or writing a check, you may easily record the relationship between you, the third party, and the subcontractor with only one click.

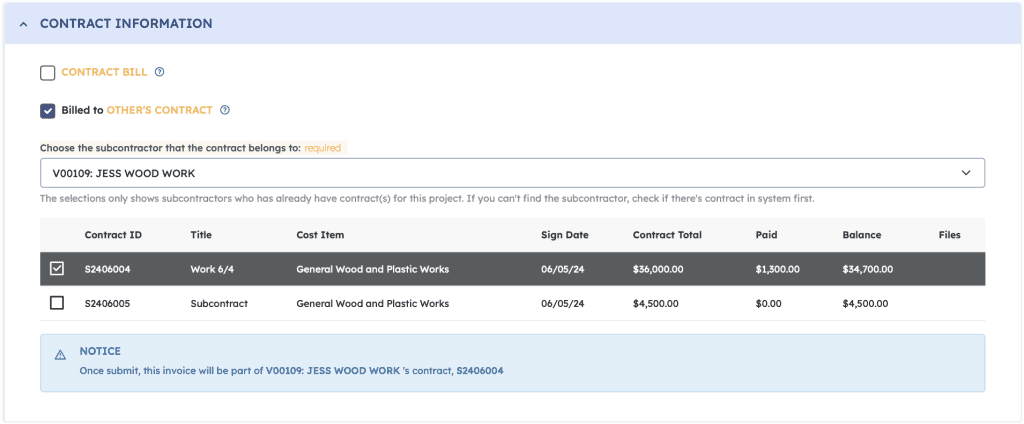

Under Contract Information, check the box next to Billed to Other’s Contract. Select the responsible subcontractor from the drop-down bar, then select the subcontract this bill belongs to.

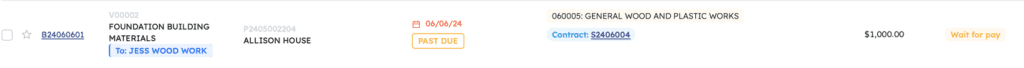

On the overview dashboard of Bills and Payments, the transaction is automatically generated. With simple clicks, the bill is recorded and relationship is clearly identified by the blue note “To: Jess Wood Work”.

10 FAQs About Complex Construction Accounting Using APARBooks

-

How does APARBooks help manage third-party bills in construction projects?

APARBooks allows you to record a bill from a third party (not under direct contract with you) and automatically associate it with the responsible subcontractor using a simple, one-click system. -

What’s the benefit of using APARBooks to track indirect transactions?

APARBooks eliminates confusion by clearly identifying the relationship between the general contractor, third party, and subcontractor, reducing the risk of disputes and errors. -

Can APARBooks adjust subcontractor contract amounts automatically?

Yes. When recording a bill related to a subcontractor’s contract, APARBooks enables you to apply the deduction directly to their contract, ensuring accurate financial records. -

How does APARBooks prevent financial discrepancies?

By offering structured workflows and automatic tracking, APARBooks ensures that all bills and deductions are accurately reflected in your accounting system, reducing discrepancies. -

What happens if you don’t use a system like APARBooks to handle third-party payments?

Without a tool like APARBooks, you risk financial inaccuracies, cash flow issues, potential legal disputes, and a damaged reputation due to unclear financial records. -

How easy is it to link a bill to a subcontractor in APARBooks?

Very easy — just check the “Billed to Other’s Contract” box under Contract Information, select the subcontractor and related subcontract, and you’re done. -

How does APARBooks improve transparency in construction accounting?

APARBooks displays transactions with clear labeling (e.g., “To: Jess Wood Work”) and organizes bills/payments on the dashboard, offering complete transparency and audit-ready records. -

Does APARBooks integrate with project management tools?

Unlike traditional systems, APARBooks is designed for integration, allowing seamless coordination across billing, project tracking, and subcontract management. -

What kind of accounting flexibility does APARBooks provide?

APARBooks supports complex billing structures, including payments to third parties on behalf of subcontractors, without requiring manual workarounds. -

Why choose APARBooks for complex subcontractor relationships?

APARBooks is purpose-built for general contractors, offering automation, clarity, and control over intricate financial workflows that legacy systems can’t handle efficiently.