As a general contractor, your success relies heavily on the support of subcontractors. Maintaining good relationships with them is crucial for finishing jobs efficiently and effectively. However, one of the most common issues that can strain these relationships is messy accounting records.

The Problem: Messy Accounting Records

Imagine this: You pay for materials upfront and deduct this expense from the total committed contract value with your subcontractor. But when the job is complete, the subcontractor forgets about this deduction and demands the remaining balance. This misunderstanding can lead to disputes and damage your professional relationship.

Furthermore, while it might seem easy to avoid these problems by organizing invoices and transactions, the reality is much more complicated. GC’s often face dozens of invoices daily, making it challenging to keep everything organized and accurately connected to each project.

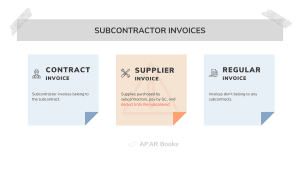

Challenge 1: Multiple Invoice Types Creates Confusion

Consider the complexity of handling subcontractor invoices. You have contract invoices, which are deductions directly from the contract, supplier invoices for materials you purchase on behalf of the subcontractor, also deducted from the contract, and regular invoices for services or materials outside the contract, which are charged separately.

Imagine dealing with multiple contracts under a single project. Sometimes, contract invoices also serve as change orders, affecting both the contract balance and the total contract value. Additionally, suppliers often bill you directly for materials provided to subcontractors, adding another layer of financial tracking.

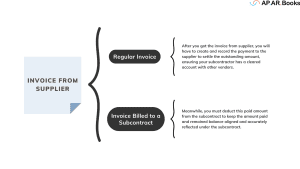

Challenge 2: Handling Invoices From Suppliers

Another layer of complexity arises with suppliers. It’s common for subcontractors to get materials from suppliers and then have the suppliers send the invoices directly to the general contractor for deduction from the subcontractor’s contract. These supplier invoices fall into two categories: regular invoices and invoices billed to a subcontractor contract.

Checking these invoices can become a huge headache, especially when multiple subcontractors get supplies from the same supplier. You then receive numerous invoices, each needing to be accurately attributed to the correct subcontract and deducted appropriately. This scenario can quickly lead to financial chaos without a streamlined system in place.

The Importance of Clear Ledger

Having a clear picture of your ledgers ensures that you stay within your project’s budget. You can monitor expenditures and make informed decisions about resource allocation, preventing overspending and helping maintain financial goals throughout the project lifecycle.

Clear ledgers also provide a real-time view of your cash flow. You can track payments made and outstanding balances, ensuring that you have sufficient funds to cover ongoing expenses. This helps avoid cash flow shortages that could halt project progress.

With a transparent system, you can hold subcontractors accountable for their financial transactions. This includes verifying the accuracy of invoices, tracking payment schedules, and ensuring that all financial dealings are properly documented. By keeping a close eye on subcontractor and project finances, you can identify potential financial risks early. This includes spotting discrepancies in billing, identifying late payments, and addressing any financial irregularities before they escalate.

Clear ledger tracking fosters trust and good relationships with your subcontractors. Timely payments and transparent financial dealings demonstrate professionalism and reliability, encouraging subcontractors to prioritize your projects and offer better terms.

The Impact of Inaccurate Subcontractor Ledger

Failing to carefully track and manage subcontractor finances can have several negative consequences. Without clear financial tracking, unnoticed overspending can strain your budget and affect project profitability. Poor cash flow management can delay payments, halting work and disrupting timelines. Inaccurate records can lead to disputes over payments, resulting in strained relationships and legal issues.

Sounds Familiar?

If you’re nodding in agreement, you know that these financial intricacies are common but tricky to handle in the construction industry. Without a detailed ledger tracking system, errors, miscommunications, and strained relationships can happen with your subcontractors.

The Solution You Need: APARBooks

Enter APARBooks, a construction accounting system designed to alleviate these challenges. With APARBooks, you gain a clear, organized view of your financials and project details.

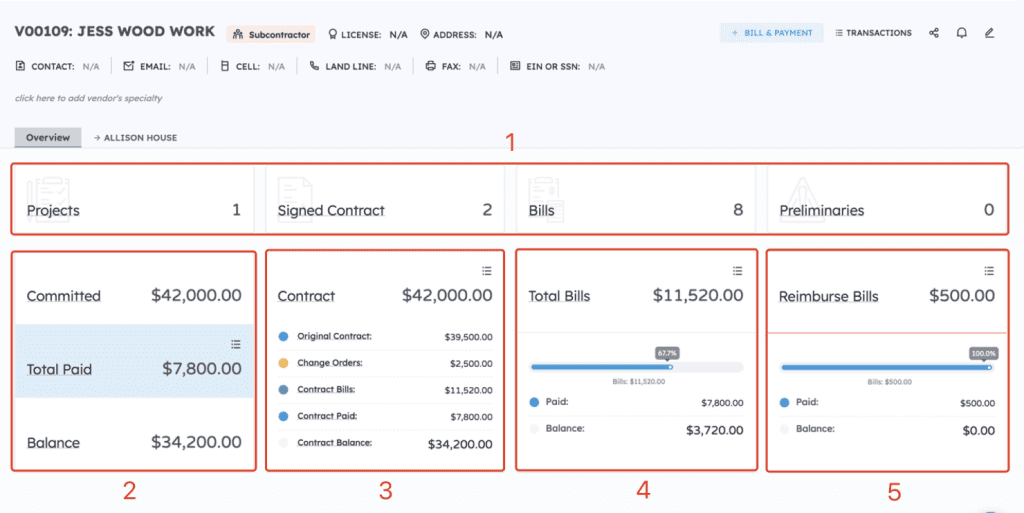

Overview Dashboard: Your Summarized Ledger

This is an example of the overview dashboard for a subcontractor, Jess Wood Work. Key financial metrics such as the total committed amount, total paid, and balance are clearly displayed.

1. On the top of the dashboard, you can quickly view the numbers of projects, signed contracts, bills, and preliminaries that this subcontractor owns in relation to you.

2. Total committed amount of $42,000, out of which $7,800 has been paid, leaving a balance of $34,200 awaiting to be paid.

3. Under the $42,000 contract, detailed finances are broken into categories for a closer look to easily track how much has been paid, changed, and owed. This section includes subcontractor bills, including regular invoices and supplier invoices.

4. Total bills records all bill received related to the signed contracts with this subcontractor. The amount paid and awaiting-payment-balance is shown, along with a progress bar to easily view your billing progress.

5. Jess Wood Work has paid $500 out-of-pocket and required a reimbursement from you. The amount paid and balance, along with the progress bar, shows that you have paid off all the reimburse bills.

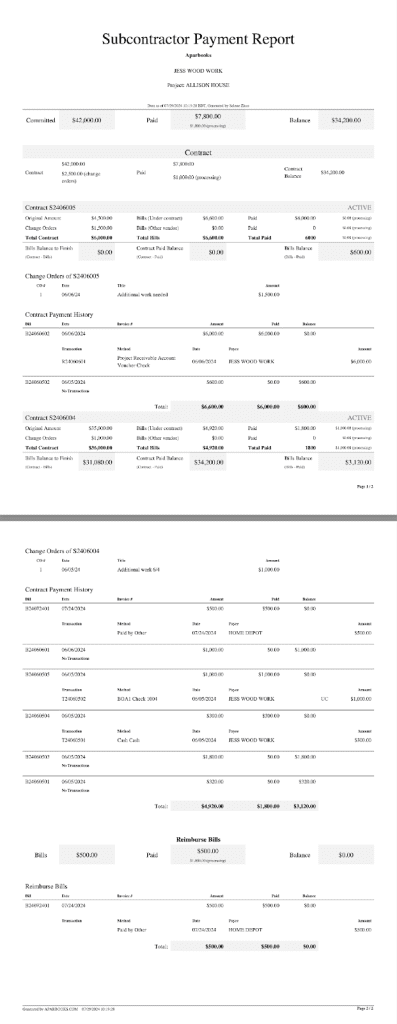

Detailed Project Insights: Drill Down with Ease

Continuing with the example of Jess Wood Work, and we will dive deeper into the specifics of the Allison House project. APARBooks system provides you the option to export the project into pdf or excel file for your sharing and calculating purposes.

In the following report in pdf file, you can view all transactions under this project.

Having this level of detail at your fingertips allows you to manage each vendor’s contributions and financials efficiently. You can track which bills are pending, which have been paid, and how much is left to be paid. This transparency helps prevent financial discrepancies and ensures smooth communication with your vendors.

Why Choosing APARBooks?

APARBooks provides an at-a-glance view of your financial commitments, payments made, and outstanding balances. This helps you quickly assess the financial health of your projects and make informed decisions.

Each project dashboard in APARBooks displays detailed information, including contract amounts, change orders, bills issued, payments made, and remaining balances. This level of detail allows for comprehensive project tracking and recording.

You can track financial transactions and project involvement for each subcontractor separately. This helps in maintaining clarity and accountability, ensuring that each subcontractor’s contributions are properly documented and managed.

With detailed tracking and real-time updates, APARBooks helps you identify potential financial risks early. You can spot discrepancies, monitor payment delays, and address issues before they escalate.

Having a copy of your financial reports tailored to your specific needs is crucial when you want to have on-paper documents. APARBooks delivers the report you need in the format you prefer in a simple click.

Don’t let financial complexities hold your projects back anymore.

By adopting APARBooks, you can overcome the challenges of managing multiple projects and finances. With a clear, organized view of your financials, you can focus on what you do best: delivering quality construction projects on time and within budget.

Sign up for a demo now and discover how we can help you manage your construction finances with ease and precision.