What you’ll learn

How to identify and prevent project financial misreporting using proper WIP tracking

How to leverage real-time project data to maintain accurate profitability forecasts

How to implement effective financial controls for large-scale construction projects

What you’ll need

- A comprehensive construction accounting system with WIP reporting capabilities

- A structured process for regular project financial review and reconciliation

- Clear communication channels between project managers and accounting teams

The Problem

Martinez Construction, a family-owned contractor in Austin, Texas, took on their largest project yet – a $4.2 million multi-family development. By mid-project, basic accounting showed $1.8 million in costs against $2.4 million in revenue, suggesting healthy profits.

However, Robert Martinez, the owner of Martinez Construction, discovered they had only completed 45% of the work. Their simple spreadsheet system had masked rising material costs and labor rates, creating a false sense of profitability.

The Hypothesis

Maria Martinez, who managed the books while coordinating with subcontractors, realized they needed better tools to handle larger projects. After researching solutions, she believed APARBooks could provide the right balance of construction-specific features without overwhelming their small team.

The Solution

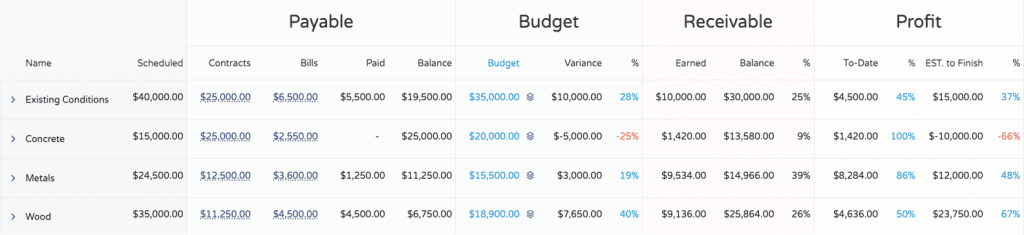

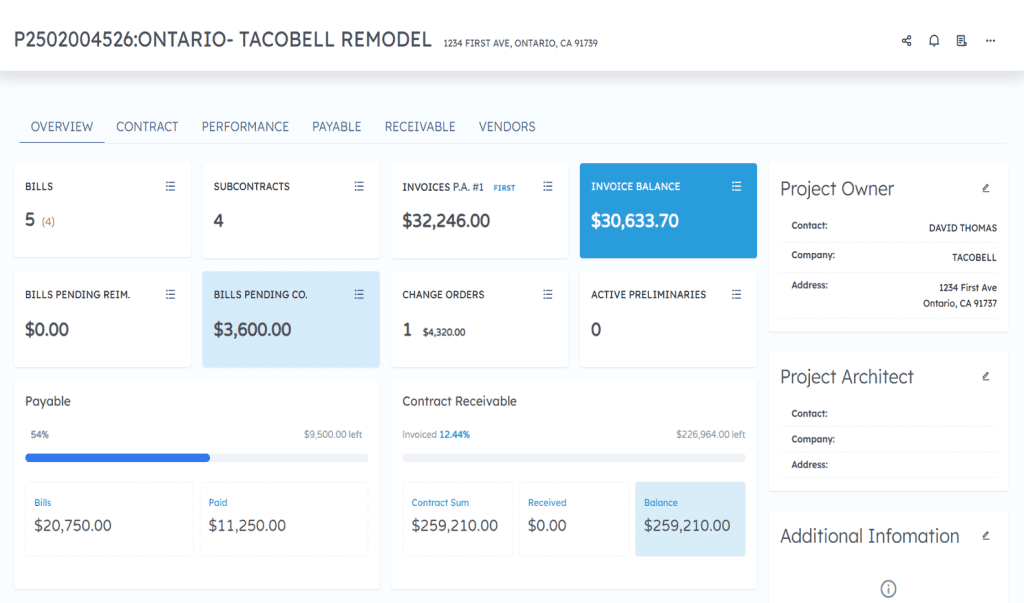

APARBooks equipped Martinez Construction with straightforward tools that made a big difference. The real-time recording and tracking feature allowed for daily progress updates, and cost and billing tracking replaced confusing spreadsheets.

Easy-to-understand WIP reports gave instant project snapshots. The team set up a weekly 30-minute review meeting, with the collaboration function on the system, they were able to keep everyone on the same page, and use clear visuals to spot and solve problems early.

The Impact

The transformation came quickly. Within six weeks, reporting time shrunk from 4 hours to just 30 minutes each week. They caught cost overruns early enough to protect their profits. Subcontractors appreciated more timely payments, while clients valued the professional reporting and clear communication.

“APARBooks helped us grow beyond basic accounting while keeping our hands-on approach,” says Maria. “We can now take on bigger projects with confidence, knowing we have full visibility into our finances.”

Their story shows how the right tools can help small contractors grow without losing control or compromising quality. Small construction companies don’t need complicated systems – they need practical solutions that fit their way of working.