Tracking payments, managing multiple projects, and recording bills have always been a headache for general contractors. It sounds easy to manage when there is only one contract from a subcontractor, but what happens if you must accurately categorize multiple bills under different projects?

Imagine this: you’re a general contractor overseeing multiple projects, and your subcontractors work with you on different projects. After one of your subcontractors submits multiple invoices on different projects, you struggle to efficiently categorize, allocate, and deduct the payments from the correct contract.

In the construction industry, both subcontractors and general contractors face unique challenges that complicate financial management. While subcontractors need to ensure their invoices and records are accurate, general contractors must juggle the financial details of multiple projects simultaneously.

In the following blog, these common challenges highlight the need for effective systems and processes to maintain clarity and efficiency. Read on to discover how you can easily allocate, manage, and track the process on any payments.

Challenge 1: Managing Multiple Invoices and Projects

Both subcontractors and general contractors deal with multiple projects simultaneously. Subcontractors submit numerous invoices for different projects, while general contractors must keep track of these invoices across various jobs. This can lead to confusion and errors, as each party struggles to organize and manage a large volume of financial documentation.

Challenge 2: Timely and Accurate Record Keeping

Maintaining detailed records is essential for both subcontractors and general contractors. Subcontractors need to track labor, materials, and change orders for each project, while general contractors must ensure these details are correctly recorded and allocated to the appropriate project and contract. Without a fast and simple system, both parties could face delayed payments or unnecessary disputes due to invoice errors.

Challenge 3: Invoices Sent Outside the Contract

Sometimes, third parties, such as material supplier, may send in invoices outside the contract, such as pending payments billed to the subcontractor involved in the project. In such cases where instead of the subcontractor, the material supplier sends in a bill that needs to be deducted from the total subcontract amount, having a traditional accounting system could not accurately reflect the correct relationships between the payer and payee.

Consequences of Mishandling Bills and Payments

Mishandling bills and payments can lead to severe consequences, including financial strain, legal disputes, project delays, and reputation damage.

Misallocated payments can disrupt project budgets, leading to financial discrepancies that complicate project management. Additionally, delayed payments due to disorganized invoicing can strain relationships between general contractors and subcontractors, potentially causing work stoppages or delays.

Inadequate record keeping can lead to delays in payment processing, causing cash flow issues for subcontractors. For general contractors, inaccurate records can result in budget overruns and difficulties in financial reporting. This lack of clarity can also cause disputes over work completed and payments due, further delaying project timelines and creating legal complications.

How Can APARBooks Help?

At APARBooks, we understand these challenges and have developed a robust construction accounting system designed specifically to meet the needs of small to mid-sized construction companies.

Our system provides a comprehensive dashboard that simplifies the tracking of change orders, payments, and transactions, making financial management smoother and more transparent.

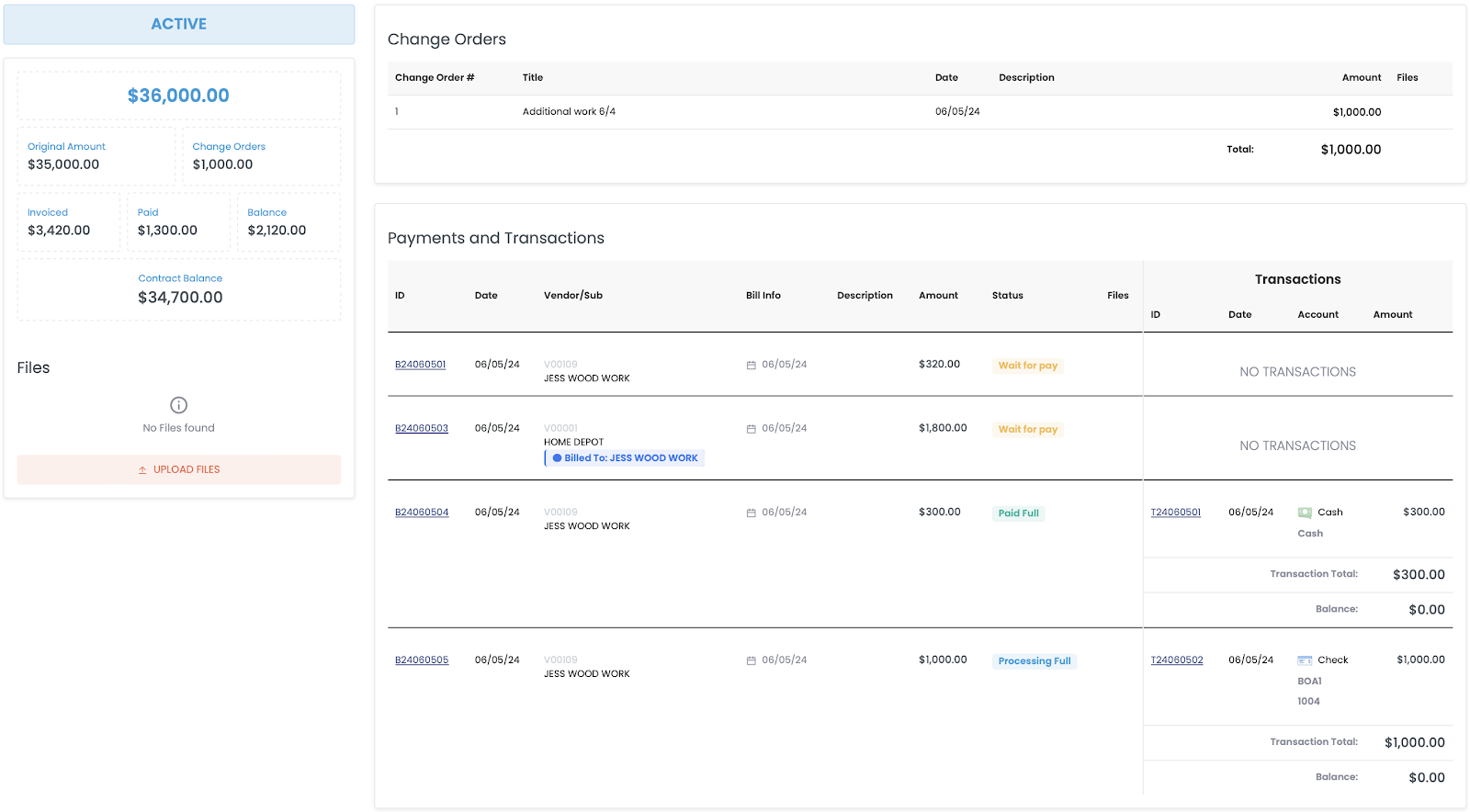

Overview Section:

This section provides a quick snapshot of your subcontract’s financial status. It includes the original contract amount, change orders, invoiced amounts, paid amounts, and the remaining balance. This summary helps you keep track of the overall financial health of your subcontract.

You may attach any files related to bills and payments under this contract, keeping all documents securely stored and easily accessible whenever needed. This feature ensures that all relevant documents are organized and readily available for reference.

Change Orders:

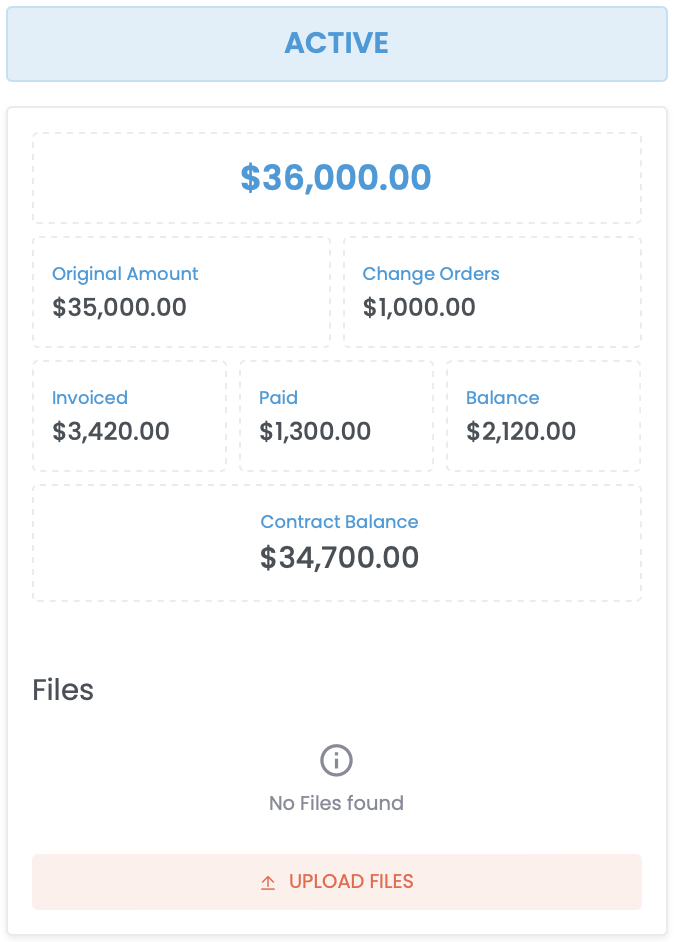

Detailed Tracking

This section lists all the change orders associated with the subcontract, including the change order number, title, date, description, and amount. By having all change orders documented and easily accessible, you can effectively manage project scope changes and their financial implications

Total Calculation

The total amount for all change orders is calculated and displayed, providing a clear view of additional costs beyond the original contract.

Payments and Transactions

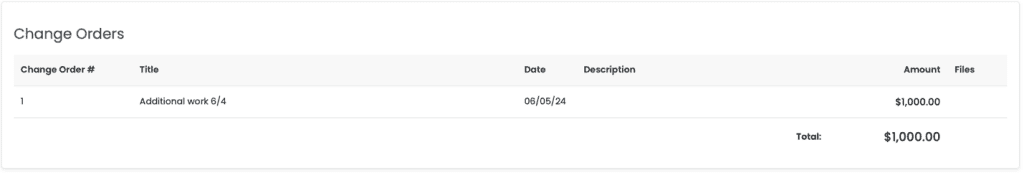

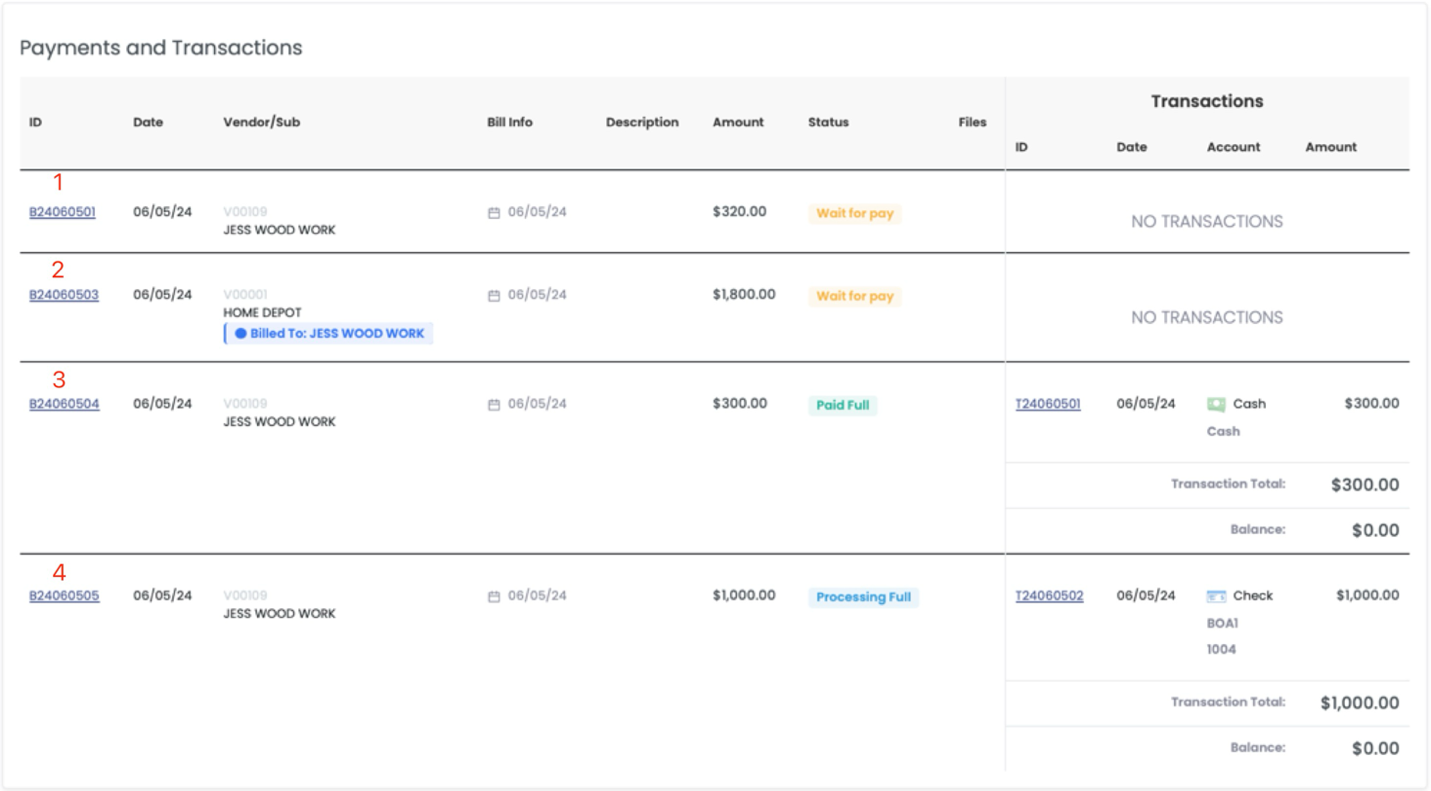

Comprehensive Record-Keeping

This section records all payments and transactions under the subcontract. It includes details such as the transaction ID, date, vendor/subcontractor, bill info, description, amount, status, and related files. Each entry is tracked to ensure accuracy and transparency.

Transaction Details

For each payment, you can view detailed transaction information, including the account used, amount, and transaction status. This ensures complete transparency and helps in maintaining precise financial records.

Special system management on complex bill relationships

APARBooks can record different types of bills and payments, and clearly display the complex relationships between parties.

Example 1: GC receives a bill directly from the subcontractor. The bill is waiting to be paid.

Example 2: GC receives a bill from a material supplier, and it is waiting to be paid. The transaction is between the subcontractor and the material supplier for activities under the current subcontract, so the bill amount will be deducted from the total subcontract amount. This relationship is displayed by![]()

Example 3: GC receives a bill directly from the subcontractor. The bill fully and paid, and the transaction details are displayed on the right.

Example 4: GC writes a check to the subcontractor, and the check is in process. The transaction details are displayed on the right.

Benefits of Using APARBooks

Recognizing the critical importance of efficiently managing bills and payments, APARBooks is specifically designed to address accounting challenges in small to mid-sized construction companies. Our solution focuses on simplifying every process, ensuring seamless financial management and efficient operations.

User-Friendly Interface

Designed with simplicity in mind, APARBooks offers an intuitive interface that is easy to use, even for those with limited accounting experience.

Managing Change Orders

Our system provides detailed tracking and documentation of all change orders, helping you manage scope changes effectively and avoid unexpected costs.

Tracking Payments and Transactions

With comprehensive record-keeping and detailed transaction information, you can ensure that all financial activities are accurately tracked and accounted for.

Maintaining Financial Transparency

By providing clear and accessible financial summaries and transaction details, APARBooks enhances transparency and helps maintain trust with stakeholders.

Storing and Accessing Documents

Our secure file upload and storage feature ensures that all relevant documents are organized and easily accessible, reducing the risk of lost or misplaced files.

By leveraging our construction accounting solution, you can mitigate the risks associated with bill management, leading to more successful projects and stronger client relationships. Embrace the future of construction management and elevate your business operations with our innovative solution.

Ready to transform your construction project management and streamline your accounting processes? Don’t let the complexities of bill management hinder your success.

Contact Us Today to schedule a demo and see how our construction accounting solution can benefit your business.