As the owner of Sam Construction, a small contracting business in its second year, I thought I had a handle on things. We’d just wrapped up a significant year-long project, and I was looking forward to reviewing our performance. That’s when the trouble started.

One day, I found myself spending hours trying to reconcile our books with the expenses and invoices from our subcontractors. The more I dug into the numbers, the more confused I became. Our books simply weren’t adding up with what the subcontractors were claiming.

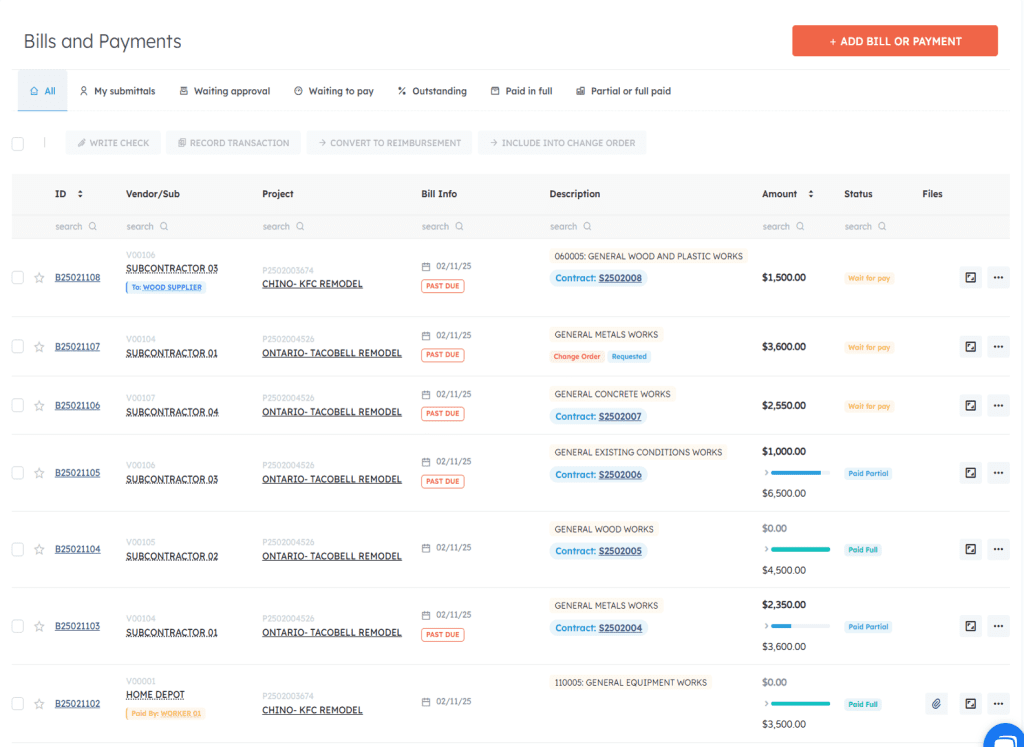

Some subcontractors insisted they had completed extra work that wasn’t accounted for in our records. Others claimed they hadn’t received payments that our books showed as paid. It was a mess, and I couldn’t make sense of it.

Trying to sort this out, I reached out to the subcontractors. But instead of clearing things up, these conversations often turned into disagreements. Our books were confusing to both parties, and neither side could definitively prove their case. It was frustrating for everyone involved.

The situation started to affect our business beyond just the bookkeeping. In our small town, word gets around quickly. Some potential customers became hesitant to work with us and turned to other general contractors instead. Our relationships with subcontractors were damaged, making it harder to collaborate on future projects.

I knew I needed to find a solution, but I wasn’t sure where to start. That’s when I mentioned my headache to a friend over coffee. He listened to the challenges I was facing and then suggested I look into a platform called APARBooks.

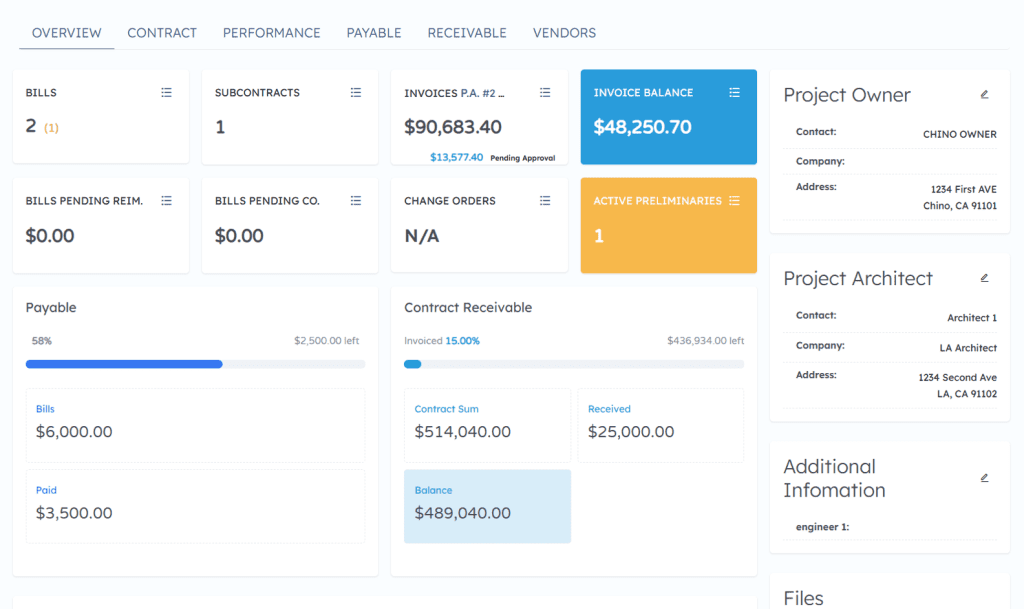

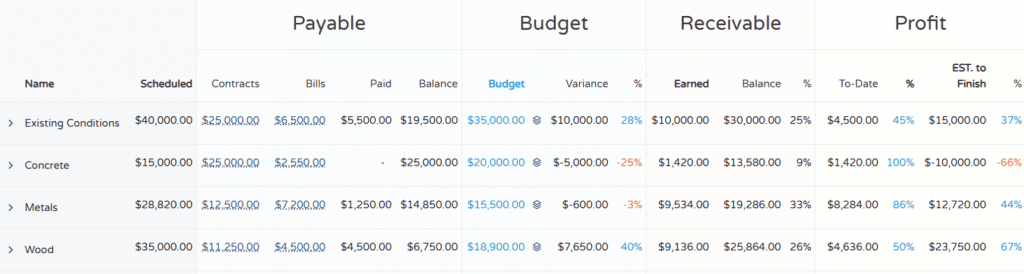

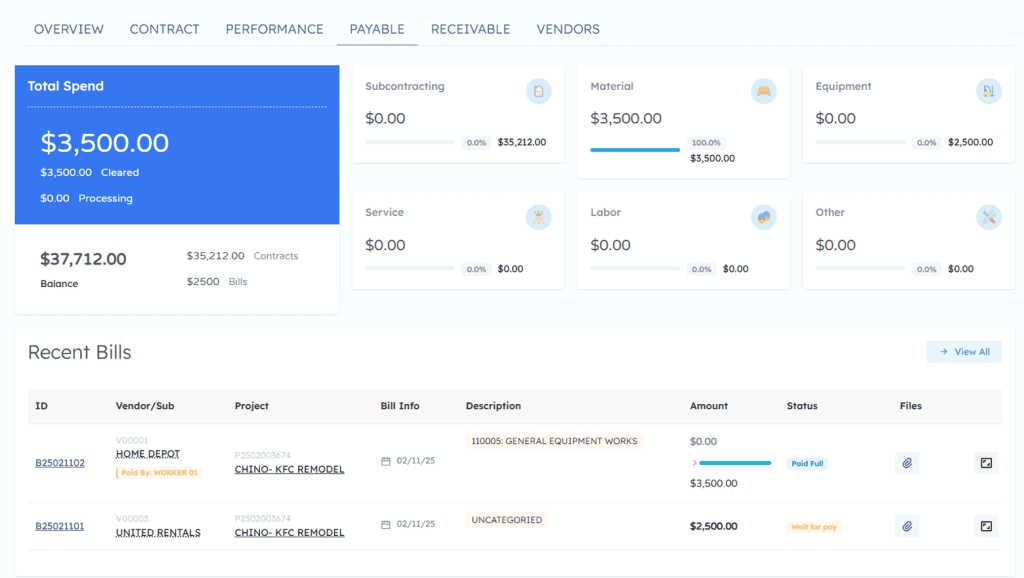

I decided to check it out. As I explored the features, I quickly realized that APARBooks offered solutions to many of the problems I’d been facing. The platform provided real-time project cost tracking, which would help prevent discrepancies from piling up over time. It also offered integrated invoicing and payment management, which could help avoid the confusion over paid and unpaid invoices.

What really caught my attention was the clear audit trail for every transaction. This could be invaluable in preventing future disputes with subcontractors. APARBooks offered project cost tracking, real-time financial reporting, integrated invoicing and payment management, collaboration tools for better communication, and expert support from construction industry professionals.

Implementing APARBooks took some time and effort — there was a learning curve for my team. But slowly, we started to see improvements. Invoices were easier to track and reconcile. Communication with subcontractors became clearer, with a digital trail for every transaction and change order.

Today, our books are clearer and more accurate. We’re able to catch and address discrepancies early, before they turn into major issues. Our relationships with subcontractors have improved, and we’re rebuilding our reputation in the community.

For any fellow contractors out there, especially those just starting out, I can’t stress enough the importance of having a solid system for financial tracking and reporting. It’s worth investing in the right tools from the start. In my experience, it can make the difference between constant headaches and smooth operations.

I’ve always liked the saying that, in construction, what you build is only as strong as its foundation. The same goes for your business – make sure your financial foundation is solid. Your business, and your peace of mind, depends on it.