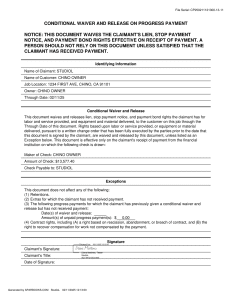

For general contractors, managing payments in complex projects means handling many moving parts, including strict lien waiver requirements before releasing funds to vendors. Lien waivers are essential to ensure project funding, but even minor errors—like a typo, incorrect dates, or wrong amounts—can cause significant payment delays. These delays stall project progress, and with fixed contract dates looming, even small setbacks can snowball into major issues that affect the entire operation.

Horizon BuildCo, a growing GC that specializes in multi-use development projects involving multiple subcontractors and vendors. With a particularly complex project underway, the funding source required flawless lien waivers for each payment release to ensure all prior work had been paid for. The accounting team at Horizon BuildCo was tasked with creating and submitting dozens of lien waivers. However, manually inputting details meant occasional errors like typos, incorrect amounts, or mismatched project locations.

In one instance, a vendor lien waiver listed the wrong project address due to oversight, while another waiver had a math error in the total amount. These small mistakes held up substantial payments from the client. Without these funds, Horizon BuildCo’s cash flow stalled, making it difficult to pay subcontractors and delaying progress on-site.

The project manager, already on a tight schedule, saw weeks of work pushed back, impacting timelines and putting strain on vendor relationships. It was clear that relying on manual processes for creating lien waivers was not sustainable, especially with multiple cross-payment relationships in play.

Horizon BuildCo turned to APARBooks for a comprehensive solution. APARBooks’ system enabled them to generate lien waivers using a unified template, ensuring consistency and reducing the chance of errors. The platform automatically calculated the total amounts needed, eliminating math mistakes and manual input errors. By centralizing lien waiver documentation and timestamping each entry, APARBooks made it easy for the accounting team to track and access completed waivers quickly whenever needed for verification or audits.

With APARBooks, Horizon BuildCo could submit error-free lien waivers promptly, securing timely payments from the client and maintaining steady cash flow. The reduction in manual errors meant that waivers no longer bounced back for corrections, cutting out days or even weeks of unnecessary delays. Payments that previously took weeks to process due to waiver errors were now released in a timely manner, keeping projects on schedule and maintaining vendor trust. The system’s built-in tracking and secure storage provided peace of mind, knowing that every waiver was accurately filed and accessible at any moment.