The Challenge: Missing WIP Reports Lead to Budget Crisis

“I never thought missing a few WIP reports could spiral into such a massive problem,” recalls Claire Morgan, owner of Premier Construction. “When my project manager left unexpectedly during our $2.8M office renovation project, those monthly reports fell through the cracks. It seemed minor at the time – we were busy, the project was moving forward, and payments were coming in. But that oversight nearly cost us everything.”

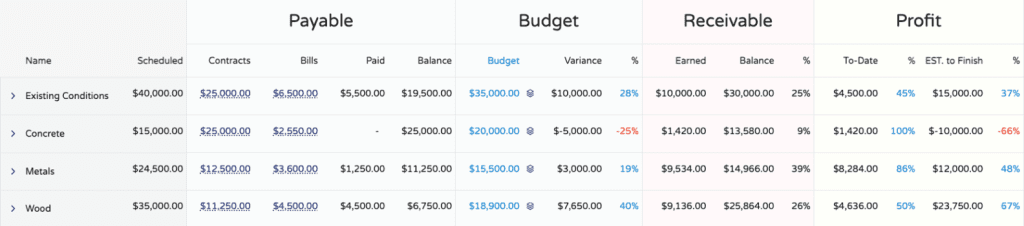

Claire found herself in a situation familiar to many general contractors. Without regular Work-in-Progress reporting, her team lost visibility into their actual financial position.

“We were essentially flying blind,” she explains. “Materials were being ordered, subcontractors were working, but we had no real-time view of how these costs compared to our budget or collected payments.”

The Impact: When Small Oversights Create Big Problems

By the time Claire discovered the issue, her project was 15% over budget, with significant cash flow problems threatening not just this project, but her entire business.

“The most frustrating part wasn’t just the money – it was explaining to our client why we needed additional funds without having detailed tracking to back up our requests,” Claire shares.

“Our reputation took a hit. We’d built our business on transparency and reliability, and suddenly we were struggling to justify cost overruns. Some of our best subcontractors started hesitating to bid on our projects because of delayed payments.”

The financial impact manifested in unexpected cost overruns of $420,000, which led to three weeks of project delays while securing additional financing. The company faced a 22% increase in interest expenses from emergency loans, and perhaps most damagingly, lost two potential projects due to their damaged reputation.

The APARBooks Solution: Real-Time Financial Control

“APARBooks completely transformed how we handle project finances,” Claire states. “Their system automatically tracks every dollar spent and earned, giving us real-time visibility into our financial position.”

The transformation began immediately with automated daily cost tracking and real-time budget comparisons. The system’s integrated change order management and automated WIP report generation eliminated the manual tracking that had previously fallen through the cracks. A comprehensive cash flow forecasting dashboard gave Claire’s team the confidence to make informed decisions about resource allocation and project timing.

“Now, if costs start creeping up in any category, I know immediately,” Claire explains. “Just last month, the system flagged that our electrical work was trending 8% over budget. We caught it early, adjusted our approach, and avoided what could have been another significant overrun.”

Three months after implementing APARBooks, Premier Construction witnessed remarkable improvements. Their project profit margins increased by 12%, while payment cycles shortened by 28%. The company eliminated surprise cost overruns entirely and maintained perfect on-time supplier payments.

“The best part? Our clients love the transparency. They can see exactly where their money is going, and we can confidently demonstrate our financial management capabilities. It’s not just software – it’s peace of mind.”

*This case study is based on a real customer experience. Some details have been modified to protect client confidentiality.*