As a general contractor, what questions that you may be asking yourself before creating an invoice…

What are the different invoice formats?

What invoice format is the project owner requiring?

How to manage invoices with varying project owner requirements?

How can I have a more efficient way to create my forms?

How do I ensure zero calculation errors?

Additionally, requirements can differ from various aspects…

Some project owners may require sub-invoices and conditional waiver

Invoices display all cost items vs. only main items

Whether invoices display zero cost items

In this blog, we will delve deeply into AIA G702 and G703 forms, exploring their purposes and components, as well as the common challenges faced when creating and managing these essential documents. Understanding these difficulties is crucial, as they mirror broader issues encountered by general contractors in their daily operations. We will also examine how the APARBooks system is designed to resolve these challenges, providing a streamlined, accurate, and efficient solution to improve your construction accounting processes.

Understanding AIA G702 and G703

AIA G702 and G703 forms are standard documents used in the construction industry for application and certification of payment. These forms are provided by the American Institute of Architects (AIA) and are commonly used in construction contracts to ensure consistent and standardized billing procedures.

AIA G702 – Application and Certificate for Payment

This form serves as the contractor’s application for payment and the architect’s certification of the amount due.

Project information: Includes parties, project/application ID, date

Application for Payment: Includes the contractor’s request for payment for work completed, materials stored on-site, and any other contractual entitlements.

Certification: The architect reviews the application and certifies the amount to be paid to the contractor.

AIA G703 – Continuation Sheet

This form is used in conjunction with the G702 form to provide a detailed breakdown of the work performed and the amount requested for each portion of the project.

Table of Work and Values: Includes a detailed list of work items, quantities, values, and amounts completed to date.

Progress Tracking: Allows tracking of progress and remaining balance for each work item.

Together, the AIA G702 and G703 forms ensure that all parties have a clear and documented understanding of the payment requests and the work completed, promoting transparency and accuracy in the payment process.

Common Challenges When Using AIA G702 and G703 Forms

Accuracy of Data Entry

Human Error: Mistakes in entering data, such as incorrect quantities, values, or percentages, can lead to inaccuracies in the payment application.

Inconsistent Updates: Failing to consistently update the forms with the latest project information can result in outdated or incorrect payment requests.

Complexity of Projects

Detailed Breakdown: Complex projects with numerous line items can make it difficult to maintain an accurate and detailed breakdown of work completed and amounts due.

Coordination: Ensuring all parties (contractors, subcontractors, architects) are on the same page regarding work progress and payment amounts can be challenging.

Documentation and Verification

Supporting Documentation: Gathering and organizing the necessary documentation to support the amounts requested in the payment application can be time-consuming and prone to oversight.

Verification: Ensuring that all items claimed are verified and approved by the architect or other relevant parties can be challenging, especially in large projects.

Change Orders and Modifications

Tracking Changes: Accurately tracking and reflecting change orders or modifications in the payment application can be complex.

Coordination: Ensuring that all changes are communicated and agreed upon by all parties involved can be a logistical challenge.

Have You Realized the Complexity of AIA Forms?

Aside from the common challenges, AIA G702/G703 are complex legal documents that require precise data entries and calculations. The forms, especially when a project has multiple parties and applications, are compounded on previous generated calculations until the project is complete, therefore leaving no room of errors. These errors can escalate when the general contractor consolidates payment applications from multiple subcontractors.

Traditionally, general contractors have relied on Excel spreadsheets to expediate the process. While other tools like emails or DocuSign can reduce the need for physical documents and in-person signatures, they pose risks to accurate version control, increasing the likelihood of errors. Spreadsheets, not being tailored for construction, contribute to payment application rejections due to human error.

Also, at this stage, you are essentially requesting permission to invoice them the amount specified on the G702. The project owner reviews the completion percentages to ensure they align with your estimate. If they agree, you get paid.

If not, they may “red line” the AIA form, adjusting your amounts and returning the forms to you. You’ll then need to update your billing system, create a new version of the application, and resubmit it. If you had recorded the original application as accounts receivable in your accounting system, you’ll need to address this change as well.

As the project progresses, this process becomes more complex because your estimated completion percentages may differ from the project owner’s. You’ll need to track the amounts you originally applied for, what you actually billed, and what you were paid. Additionally, you’ll have to update the “previous applications” amount each time you bill and include the new application amount.

How Can APARBooks Help?

APARBooks understands your headaches and concerns with traditional construction accounting processes, which often involve manual entries, extensive paperwork, and the constant risk of errors and inconsistencies.

Our innovative system is designed to alleviate these issues by automating the generation of AIA G702 and G703 forms, streamlining invoicing, and simplifying lien waiver management.

With settings that allow you to choose between single or multiple invoices, combined or individual lien waivers, and flexible cost item visibility, APARBooks ensures that you can customize your documentation process to fit the unique needs of your project.

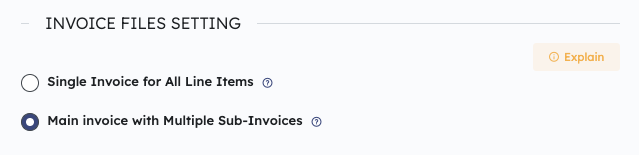

Single Invoice for All Line Items: Simplifies the billing process by consolidating all costs into one invoice, reducing the chances of errors and discrepancies.

Main Invoice with Multiple Sub-Invoices: Generates multiple sub-invoices files. It allows for detailed tracking of individual line items while still providing an overall summary.

A conditional lien waiver is a legal document used in the construction industry that releases a party’s right to place a lien on a property, but only under the condition that payment is actually received and processed.

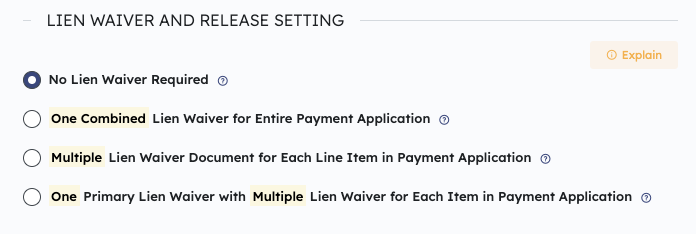

You can choose whether to generate a conditional lien waiver, as well as its type.

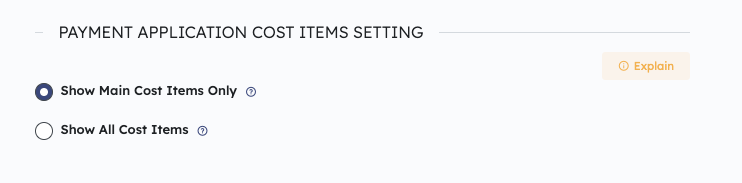

Show Main Cost Items Only: Reduces complexity by focusing on the main cost items, making it easier to review and manage the most significant costs without getting bogged down in details.

Show All Cost Items: Offers a comprehensive view of all costs, including primary cost items and sub-cost item.

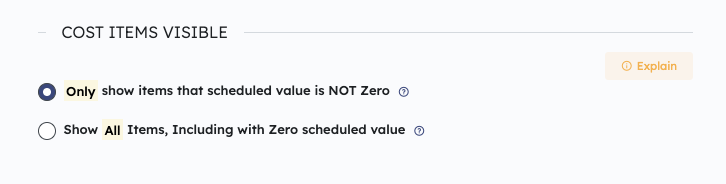

Only show items that scheduled value is NOT Zero: Keeps the invoice clean and concise by excluding items that do not impact the cost, reducing clutter and focusing on relevant information.

Show All Items, Including with Zero scheduled value: Ensures complete visibility of all items, which is useful for thorough reviews and audits, providing a full picture of the project’s financial status.

Managing AIA G702 and G703 forms can be a daunting task due to their complexity and the high level of accuracy required. However, understanding these forms and the challenges associated with them is crucial for general contractors to ensure accurate and efficient construction accounting. By leveraging modern tools like APARBooks, contractors can streamline the process, reduce errors, and enhance overall efficiency.

Don’t let the complexity of AIA forms hinder your progress. Embrace the efficiency and accuracy that APARBooks brings to your construction accounting.

Contact us today to learn more about how APARBooks can transform your invoicing process and help you stay ahead in your projects.