In the construction industry, financial transactions are often as complex as the projects themselves. One particularly thorny issue arises when a project owner pays a subcontractor directly, bypassing the general contractor. While this may seem like a simple shortcut, it creates accounting complications for the general contractor, who must then adjust the financial records accordingly.

The Challenge

You are a general contractor (GC) managing a large construction project. The typical financial flow involves the project owner distributing funds to you, which you then allocate to various subcontractors based on their contracts.

However, complications arise when the project owner makes a direct payment to one of your subcontractors for a specific transaction. You now face the task of recording this payment and deducting the transaction amount from both the overall project budget and the specific subcontractor’s account.

Now, you are facing critical questions:

How do you accurately track and record the direct payment from the project owner?

How do you ensure that both the contract amount with the project owner and the subcontractor reflect this deduction correctly?

How do you maintain transparent and accurate financial records amidst these adjustments?

Read on to see how APARBooks answers these questions with simple steps.

Importance of Resolving This Issue & Consequences if Not Resolved

Financial Accuracy

Ensuring all payments and deductions are accurately recorded maintains the integrity of your financial records.

Inaccurate recording of direct payments and deductions can lead to financial discrepancies, affecting project profitability.

Transparency

Clear and transparent accounting practices build trust with project owners, subcontractors, and other stakeholders.

Mismanagement of these transactions can result in disputes with subcontractors and project owners, potentially leading to legal issues.

Cash Flow Management

Efficient handling of direct payments and deductions helps in managing cash flow effectively, ensuring the project stays on budget and on schedule.

Poorly managed payments and deductions can create cash flow problems, impacting the overall project timeline and budget.

How Can APARBooks Help?

Our system provides an effortless fix to the challenge of direct payments with just a few clicks. You can easily record and track payments from project owners to subcontractors, ensuring that all deductions and adjustments are accurately reflected in your financial records.

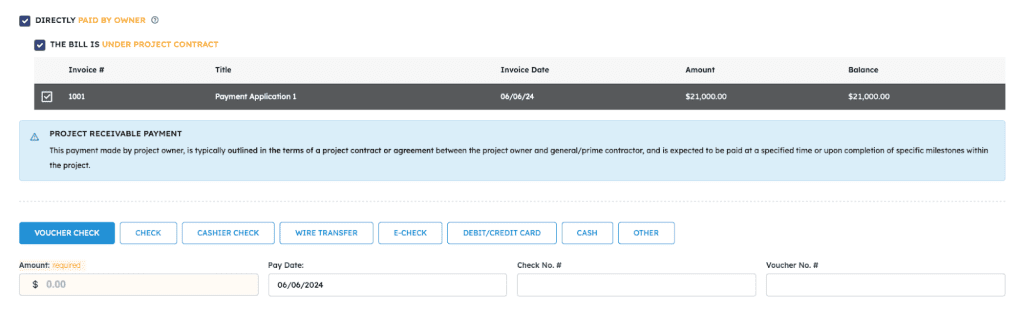

When you Record a Payment, simply check the box next to Directly Paid By Owner, this bill will be automatically noted.

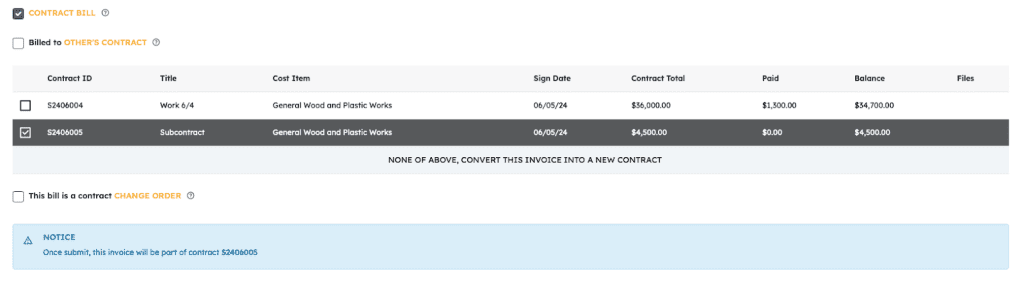

Additionally, if this bill belongs to a subcontract, you can select the subcontract that this bill belongs to.

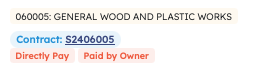

Once recording submitted, the relationship is clearly identified by the red notes “Direct Pay” and “Paid by Owner”.

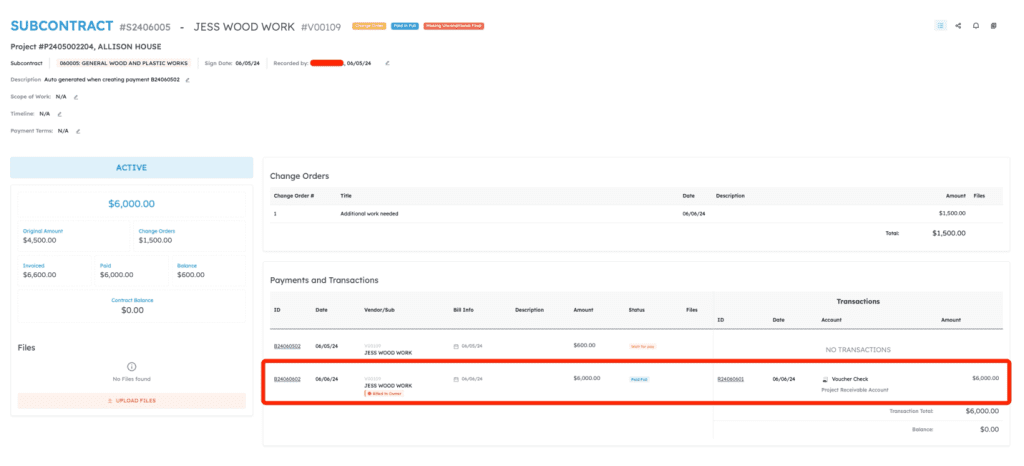

You can also track this transaction under the subcontract overview. This bill is labeled by the red note “Billed to Owner” to easily differentiate from other kinds of payment.

Why Choosing APARBooks?

Are you tired of the headaches and complexities of managing direct payments and subcontractor deductions? It’s time to experience the future of construction accounting with APARBooks. Our innovative system simplifies these challenges with just a few clicks, ensuring your financial records are always accurate and transparent.

Imagine a world where you can effortlessly track payments from project owners to subcontractors, maintain clear financial relationships, and eliminate the risk of errors and disputes. With APARBooks, this world is within reach.

Don’t wait any longer to streamline your accounting processes. Contact Us Today to schedule a personalized demo and discover how our powerful yet user-friendly solution can transform your business operations.