As a general contractor or project owner, you know that every construction project comes with its fair share of challenges. While each project may seem profitable on paper, the reality is that cash flow issues can quickly become a persistent headache. Despite the sense that your business is making money, the lack of readily available funds can be a constant obstacle, hindering your ability to operate smoothly and grow.

Cash Flow Challenges in Construction

Construction projects are inherently complex, often leading to mismatches between expenses and revenue, creating cash flow bottlenecks. Key factors contributing to cash flow challenges include:

Delayed client payments

You have high upfront costs, but clients pay slowly over time. This leaves you short of cash despite profitable projects.

Retainage withheld

Clients hold back 5-10% of the contract until the end. This impacts your cash flow, especially when working on multiple jobs.

Project delays and cost overruns

unexpected issues like bad weather, material delays, or scope changes can increase costs and timelines, draining cash across projects.

Subcontractor and supplier payments

As a general contractor, you must ensure timely payments to subcontractors and suppliers while awaiting client payments, creating a delicate cash flow balancing act.

Why it Matters for GCs and Owners?

Effective cash flow management is critical for general contractors and project owners to maintain a successful and sustainable operation. Without a clear understanding of your cash inflows and outflows, you risk facing severe financial consequences, including:

Delayed payments to subcontractors and suppliers, damaging valuable business relationships.

Missing payroll due to lack of funds, causing employee frustration and potential legal problems.

Missed opportunities for business growth and expansion due to a lack of available funds.

Having to borrow more and pay high interest, cutting job profits.

The Risks of Poor Cash Flow Monitoring

Failing to effectively monitor and manage cash flow can have far-reaching implications for your construction business. Some of the risks include:

- Project delays due to a lack of funds for materials or labor.

- Inability to secure new projects or bid competitively due to financial constraints.

- Legal issues and lawsuits from missed payments or broken contracts.

- Reputational damage, making it challenging to attract and retain skilled subcontractors and reliable suppliers.

Master Your Cash Flow and Profits with APARBooks

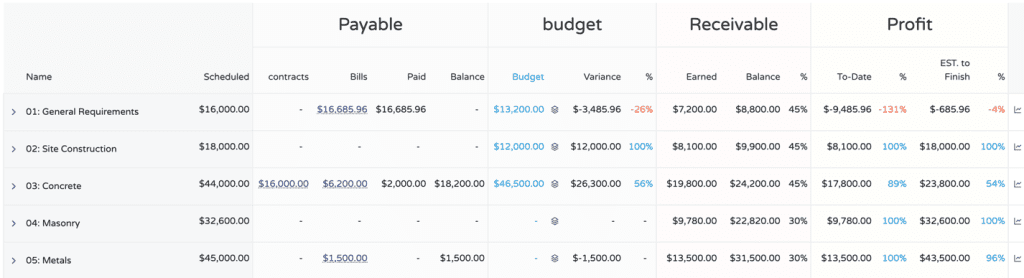

At APARBooks, our construction accounting software provides the tools you need to get a clear view of your cash flow and project profitability. One key feature is the Project Performance Table, which offers a comprehensive overview of your projects’ financial performance.

This Project Performance Table serves as a one-stop dashboard to evaluate the financial status of each construction project. It provides a comprehensive view of key metrics such as profits, outstanding payments due, and the percentage of contracted revenue already earned. By offering granular insights into the profitability of individual projects, the table delivers a transparent overview of the company’s overall financial position and economic performance. This empowers stakeholders to make informed decisions based on accurate, real-time data.

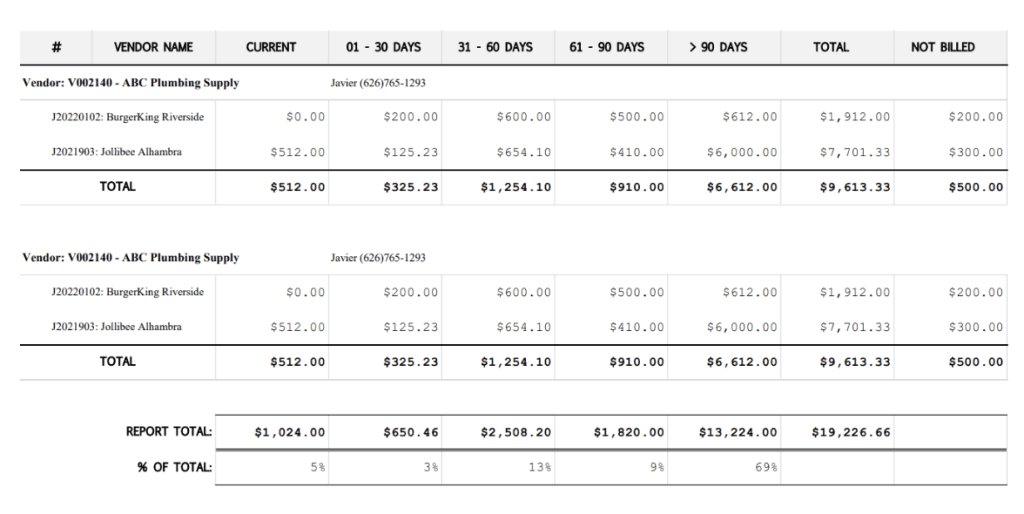

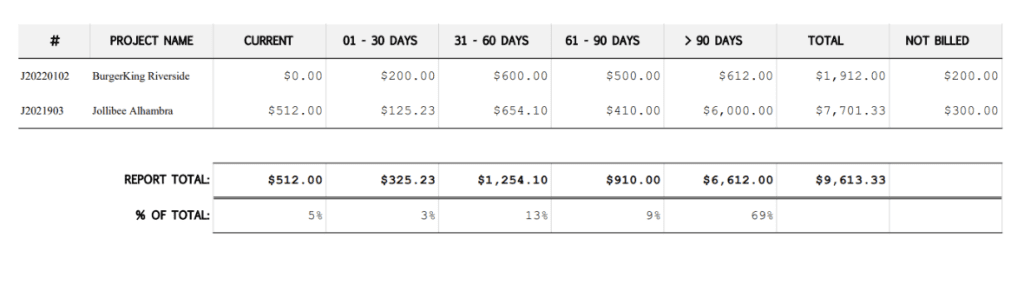

Aging Report

In addition to the Project Performance Table, APARBooks will also introduce an aging report feature to further enhance your cash flow management capabilities. The aging report categorizes your invoices and bills based on their due dates, providing a real-time snapshot of your outstanding receivables and payables.

Below are examples of the Payable and Receivable Aging Reports, which offer a clear, real-time view of your financial obligations and receivables, helping you manage cash flow efficiently.

Payable Aging Report Example

Receivable Aging Report Example

With the aging report, you can quickly identify:

- Overdue receivables that need to be collected

- Payables that are coming due soon

- Any potential cash flow crunches on the horizon

This valuable information empowers you to be proactive about collecting late payments, prioritizing expenses, and forecasting cash needs. No more surprises – the aging report keeps you informed, allowing you to take timely action to maintain a healthy cash flow.

With comprehensive financials at your fingertips

- Find your most profitable projects and focus resources there.

- See how change orders impact on your profits.

- Better forecast profitability upfront.

- Optimize budgets and resources for maximum profits.

By using APARBooks, you can unlock a new level of profitability visibility and control, ensuring that your construction projects remain financially viable and successful while navigating cash flow challenges.

Take Control of Your Finances Today

Don’t let cash flow issues hold back your construction business. Embrace the clarity and control that APARBooks offers. With our comprehensive, easy-to-use construction accounting software, you can not only monitor but also master your financial landscape. Experience firsthand how maintaining a solid grasp on your project’s financials can lead to smarter business decisions and increased profitability.

Start optimizing your operations now. Visit our website or contact us today to schedule a demo and see how APARBooks can make a difference in your business!